Moderate dynamics of monetary aggregates suggests economic stability

While certain signs of heating up have indeed surfaced on the supply side, the demand-side factors do not yet suggest such developments, which is also confirmed by the dynamics of the monetary aggregates.

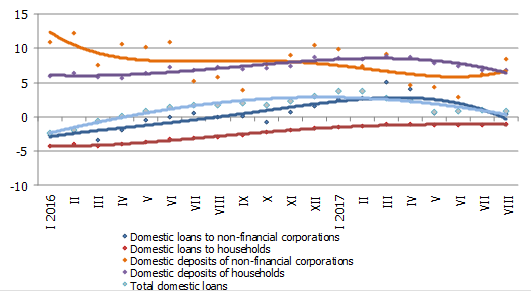

Even though new loans increased in August, the size of the loan portfolio has remained practically unchanged and its annual rate of change has also been standing close to zero for quite some time now, with loans to non-financial corporations and households growing by 0.4% and –1.0% respectively. Therefore, loans should not be viewed as a factor significantly affecting the amount of currency in circulation. While deposits with banks did rise slightly faster due to the inflows of investment and the financing of the European Union funds as well as due to an expansion of exports, the increase was only 2.7% year-on-year in August.

With loans to non-financial corporations shrinking somewhat (by 0.2%) and loans to households increasing (by 0.1%), total domestic loans remained broadly unchanged in August. The annual rate of change in domestic loans was 0.8% in August. New loans (excluding renegotiated loans) expanded by 17.0% month-on-month and by 28.5% year-on-year. Meanwhile, in the first eight months of 2017 overall the growth rate was 2.4% lower than in the corresponding period of the previous year.

Domestic deposits with banks grew by 1.1% in August. Inter alia, deposits of non-financial corporations increased by 2.1% and those of households shrank by 0.4% posting an annual growth rate of 8.5% and 6.8% respectively.

The rise in deposits also facilitated a 1.8% increase (annual growth rate – 2.8%) in Latvia's contribution to changes in the monetary aggregate M3 of the euro area. Overnight deposits of euro area residents with Latvian credit institutions, deposits with an agreed maturity of up to 2 years and those redeemable at notice expanded by 1.7%, 3.3% and 4.4% respectively.

Annual change of selected monetary aggregates (%)

No significant changes in deposit dynamics are expected at the end of 2017 and in 2018. Overall, neither the positive consumer sentiment nor the investment activity of businesses facilitate excessively rapid build-up of savings in bank accounts. Changes in lending will be moderately positive suggesting a considerably different situation from that in the pre-crisis period from 2006 to 2008 when signs of overheating were observed.

Textual error

«… …»