Manufacturing struggles not to fall from the last year's peaks

Manufacturing performance can be viewed as moderately positive in the first quarter, with no significant departures from the high base achieved at the turn of 2017.

Both external and domestic demand remained strong and the level of production capacity utilisation was rising from quarter to quarter. The future, however, is less certain as industrial confidence both in Latvia and the European Union countries overall is volatile and has been following a downward trend in the most recent months.

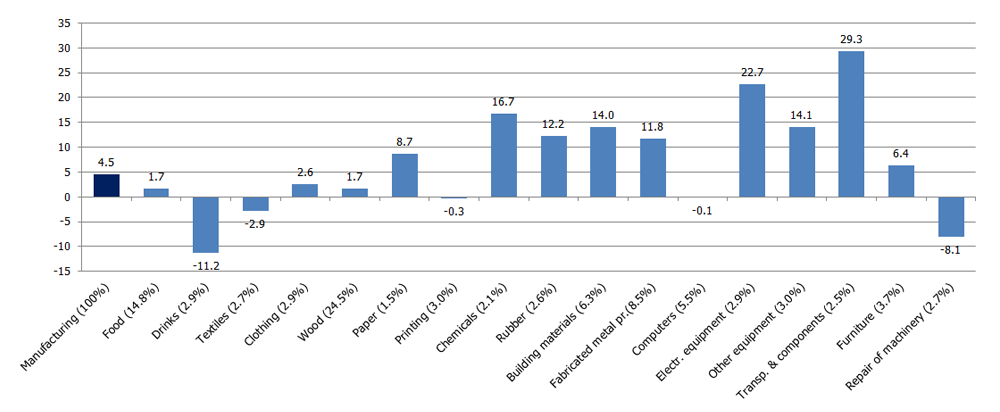

According to seasonally adjusted data, manufacturing output contracted by 0.8% quarter-on-quarter in the first quarter of 2018. Despite this fall, the calendar adjusted year-on-year rise in the first quarter of 2018 remains quite impressive at 4.5%. Almost all manufacturing sub-sectors continue to report growth, with notable exceptions being manufacture of beverages and the sub-sector comprising installation and repair of machinery and equipment as well as repair of ships and boats.

Within the last three months, from February to April, industrial confidence in Latvia has slightly deteriorated. Moreover, declining economic sentiment and industrial confidence indicators are reported for the EU countries overall, which could signal potential problems in Latvia's major trade partners. This being said, however, it is too early to speak about any negative trends as the confidence indicators are prone to volatility and are also affected by various one-off factors. Sector representatives also do not perceive any near-term problems as regards their external markets. Shortage of qualified labour and global commodity prices, particularly the exceptionally high rise of wood prices in the first quarter (albeit already starting to unwind in April), were factors having a more limiting effect on performance.

The rapidly rising wood prices caused some tensions in the wood industry: some saw this as a good opportunity to earn profit, while others faced a problem of how to buy production inputs without ending up in the red. The last winter/spring season was relatively successful for the producers of wood pulp and energy products like wood chips and particles, whereas woodworking businesses using round wood as their production input had to face the challenges posed by the elevated costs in addition to the already-mentioned limited availability problem. As to the availability of raw materials, it has improved over the most recent months. The high prices have tempted the owners of private woods to harvest timber from previously unprofitable felling sites. Moreover, the weather conditions in February and the beginning of March were favourable for logging, and timber imports from Lithuania have also grown. The magnitude of price changes differed across various products (veneer logs, pulpwood, sawlogs, etc.) and even across Latvia's regions. In Courland, the demand for raw materials and prices are higher than in other regions due to the proximity of ports and the fact that many logging businesses give preference to exports. Overall, this price volatility is an obstacle to balanced development of the sector and forward business planning, from estimating the potential impact of price adjustments on the monthly cash flow to planning future investment and finding motivation to expand business. Similar developments are also observed in other sectors. Many producers have to address the challenge of declining profit margins caused by the fact that the rising global commodity prices increase production costs, while the potential to put higher prices on final products is limited.

One of the major problems faced by manufacturing is the shortage of labour. At the same time, this could serve as an incentive to increase the degree of automation and invest in more simple-to-handle equipment as well as support the development of higher quality products and services. Similar processes are observed in virtually all sub-sectors. For example, the importance of quality and service factors in manufacture of building materials is growing: the focus is on products that can be more easily handled in production (and usually are more expensive) and on delivery at an exact time and to an exact location. Manufacturers of building materials admit that this is a tendency that can be expected to persist as several major construction projects have been launched, the availability of EU funds is high and after a several years' break the housing insulation improvement programme has restarted. These changes affecting automation and demand support productivity gains. Nevertheless, much more sizeable investment could be desired as the level of capacity utilisation in manufacturing companies is rising higher and higher. And despite the sector and business representatives mentioning the importance of automation and their plans in this regard, data on investment in machinery and equipment show no significant "leap" at the moment.

Volume indices of manufacturing sub-sectors in Q1 2018 (%; year-on-year; output weights in %)

Textual error

«… …»