Manufacturing and Covid-19 at the chess-board

There is an anecdote that says: "When I have all the cards in my hands, life suddenly decides to play chess." That is currently true of manufacturing, which has been fighting fiercely against weakening external and domestic demand already since the last year, adjusting to the situation with changing and varying degrees of success, finding new export markets, investing in more efficient production, etc. Then, all of a sudden, everything was turned upside down by Covid-19.

It should be noted that the data for the first quarter do not sufficiently reflect the situation. Actually, it is only the March data that outline the decline. Therefore, the first quarter opens a window to the seemingly distant past, but what interests us today is the current situation and what the future holds in store. What are the pressing issues today? Supplies have become more expensive, they are delayed and it is impossible to cross the border here and there. Contracting businesses and intermediate goods producers are idle. The demand has witnessed a dramatic fall in many product groups, while the production of some other groups has reached new record highs. Almost every firm has its own story to tell and its own situation. Therefore, it is also hard for the representatives of industry associations to describe the state of affairs in their particular segments.

Food processing businesses can serve as an example. Some producers increase their capacity to satisfy the rising demand (particularly for food with long shelf life, e.g. canned fish, pasta, etc.), while other producers struggle to make both ends meet (particularly the firms that produced food for caterers). Likewise, a number of businesses related to car production are forced to be idle since their customers – the large car producers in Europe – are closed at this point in time, and just lately some of them have started to resume production, albeit at lower levels than normally. There is also no demand: under the conditions of uncertainty, hardly anyone buys a new car or other more expensive durable goods.

In manufacturing, the situation differs from one subsector to another. For instance, goods related to construction, i.e. building materials, metal constructions, wood. Private investors currently take precautions and postpone their investment plans until better times. Financial resources are also limited, and banks are twice as cautious when granting loans. On the other hand, a lot of countries stimulate their economy by trying to implement public investment projects, by providing various types of support, i.e. loan guarantees, extension to the deadlines for tax payments, assistance in organising business trips for installers of construction objects, etc.

Against the background of Covid-19 and the emergency restrictions, the second quarter will provide better insight into the state of play. Then we will see the direction in which the loaded cart has moved and the distance covered like in the fable by Krylov about the swan, crayfish and pike, each of them pulling the cart in a different direction. Most likely, we will find it somewhere closer to sludge. However, no matter how troublesome the life of Latvian manufacturers is today, it should be acknowledged that the situation in Latvia is even better than in many other European countries. This is the time when the simple basic goods, e.g. food, ensure more stable sales compared to the assortment of other goods. The absence of tourists does not affect our economy as much as it does in the "old" European countries. We do not have large automotive plants, we just produce parts for these plants, but this segment is small.

However, today we can already see that countries are gradually easing their restrictions, and the foreign trade flows of goods are accelerating. Therefore, let us hope that at least the summer will make our outlook on life more optimistic. Likewise, we should hope that the previous larger investment and the improved production efficiency will strengthen the recovery from the crisis. Production of simple goods cannot be fundamental for the economy in the long run, the recovery capacity is more dependent on the production of higher value added goods and more knowledge-intensive goods as well as on the ability to adapt to changes in production chains.

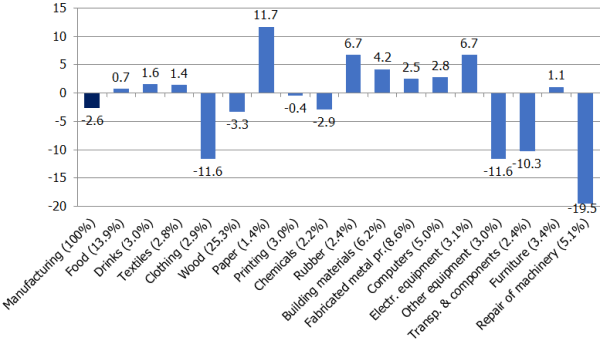

Volume indices of manufacturing subsectors in the first quarter of 2020 (year-on-year; %; output weights; %)

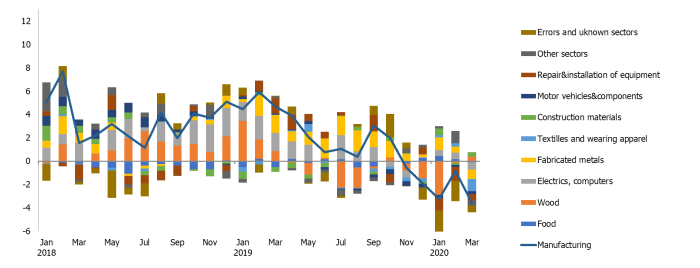

Manufacturing output (annual percentage changes; percentage point contributions)

Textual error

«… …»