Lending to promote economic growth is stagnant

The current situation with the fight against the Covid-19 pandemic is characterised by duality. On the one hand, the relatively low uptake of vaccines and the rapid spread of the Delta variant of the virus might lead to new restrictions on economic activity already in the near future, while on the other hand, the improvement of the situation in many euro area countries and elsewhere in the world gives rise to optimism about the development of external demand and the growth of Latvia's economy.

Such mutually opposite trends are reflected in the volatility of consumer and business economic sentiments, stimulating higher spending and appetite for borrowing in some months, while having a dampening effect in some others.

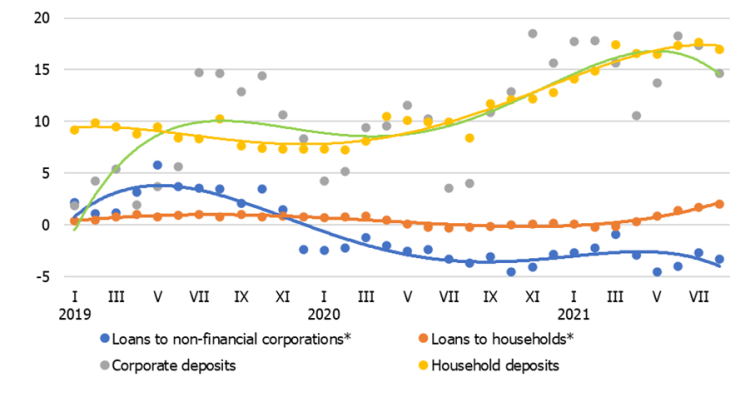

Households continued to increase deposits with banks: their annual rates of growth remained at 17%, yet the pace of their monthly increase slowed down, but in August, household deposits even declined slightly for the first time in the last two years.

At the same time, the circulation of the funds of businesses was more volatile, leading to a decline in savings for imports and investment in some months; however, the annual growth rate of corporate deposits was also high.

Lending remained subdued also in recent months: although lending for house purchase and consumer credit recorded slight increases, the portfolio of loans to businesses was volatile, with credit availability in Latvia still ranking among the lowest ones and interest rates being among the highest from the euro area's perspective.

In June, the annual growth rate of domestic deposits reached 17.7%, a high since 2007, before declining slightly to 16.0% in August (inter alia, the annual growth rates of corporate deposits and household deposits stood at 14.6% and 17.0% respectively). In June–August, deposits overall grew by 323 million euro (by 449 million euro in the previous three months), including increases of 163 million euro in household deposits (previously 456 million euro) and 160 million euro in corporate deposits (they declined somewhat during the three previous months).

In June–August, loans to domestic non-financial corporations decreased by 0.2%; however, the total loan portfolio, due to a one-off factor (the largest share of the mortgage loan portfolio of ABLV Bank, AS in liquidation purchased by AS Citadele banka in July), stable lending for house purchase and consumer credit, as well as loans to businesses from the non-bank financial sector, rose by 2.1%. In August, the annual growth rate of domestic loans reached 7.5%. Nevertheless, excluding the impact of the restructuring of the banking sector and the reclassification of institutional sectors, as well as that of one-off factors, the annual rate of change in the loan portfolio was a mere 0.1%, with the respective rates of loans to non-financial corporations and household loans standing at –3.3% and +1.9% respectively. In the second quarter of 2021, the domestic loan-to-GDP ratio, supported by stronger economic growth, decreased by 2 percentage points to stand at 39%, thus suggesting that lending to promote economic growth was stagnant.

Optimism regarding household lending was signalled by an increase in new loans, since in the first eight months of 2021, the amount of new loans granted to households expanded 1.5 times compared to the corresponding period of the previous year (the amount of loans for house purchase and that of consumer credit grew 1.7 times and by 18% respectively). At the same time, the amount of new loans to non-financial corporations remained very volatile from month to month, while their amount granted over a period of eight months posted a 15% increase compared to the low level observed a year ago.

Caution with respect to consumption and investment decisions, considering the spread of the virus and the current uptake of vaccines, might find expression in a rather reserved attitude towards new lending at the end of 2021 and at the beginning of 2022, thus widening the gap between the actually invested credit resources and those necessary for the economic development in the face of persistently higher savings. With growth being driven by private consumption in the medium term, the savings accumulated during the pandemic will be spent, and a moderate rise in deposits will be supported by rising income in the future.

Chart. Annual changes in domestic loans and deposits (%)

*For the sake of comparability, the one-off effects related to the restructuring of Latvia's banking sector and the reclassification of the institutional sectors have been excluded.

Textual error

«… …»