Lending continues to foster stable growth

In July, the rise in loans granted to nonfinancial enterprises also ensured an overall increase in domestic loans and, as a result, the total amount of the loan portfolio has reached 12.8 bln. euro. The rise in private consumption and investment has somewhat slowed deposit growth and the accruals of both the nonfinancial enterprises and households with banks dropped slightly in July.

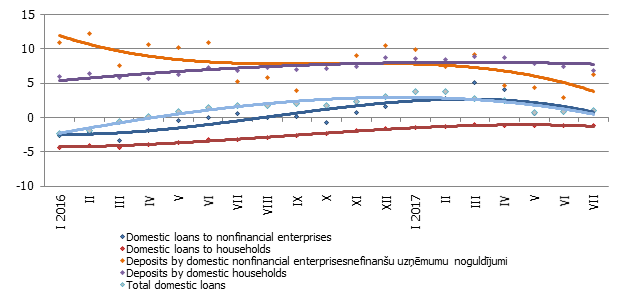

In July, the total balance of domestic loans increased by 0.3%, including loans to nonfinancial enterprises by 0.6% and consumer loans to households by 1.3%. The total household loan portfolio continued to shrink, however, with the housing loan portfolio diminishing by 0.2%. The rate of year-on-year change in loans in July was 1.0% (1.0% for loans granted to nonfinancial enterprises and –1.2% for loans granted to households).

Domestic deposits attracted by banks dropped by 0.6% in July, with the rate of their annual growth at 2.5%. Deposits of both nonfinancial enterprises and households shrank by 0.3% (the rate of year-on-year growth at 6.3% and 6.9%, respectively), with pension fund deposits dropping at a faster rate (16.6%).

With deposits dropping, Latvia’s contribution to the euro area M3 aggregate was also down (by 1.0%; year-on-year growth at 1.9%). Overnight deposits by euro area residents with Latvian credit institutions decreased by 1.0% and deposits with a set maturity of up to two years dropped by 3.1% while deposits redeemable at notice rose by 0.3%.

Y-y changes in some money indicators (%)

In the coming months, short-lived fluctuations will not change the current growth trends in monetary indicator growth – the moderate rise in lending to entrepreneurship and consumption and stability in the level of attracted deposits. In housing loans, portfolio growth may resume as a result of the improvement in the assessment of the country’s overall economic growth (data of the “Latvian barometer of the Baltic International Bank”) and rising incomes. It will also be impacted by the August decision by the Government to grant additional financing to the Development Finance Institution Altum for the continuation of the programme for the support for housing guarantees.

Textual error

«… …»