Latvijas Banka has revised its GDP and inflation forecasts for Latvia

Latvijas Banka has published its March 2021 macroeconomic forecasts, including the latest GDP and inflation forecasts for Latvia.

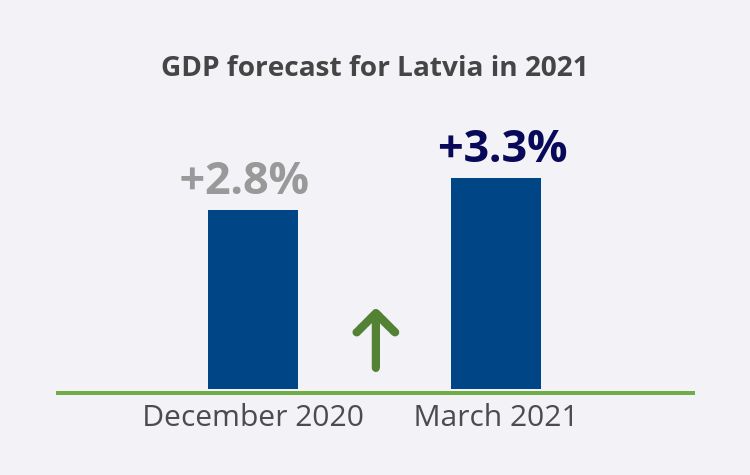

According to them, Latvia's GDP will increase by 3.3% and 6.5% in 2021 and 2022 respectively (in December, GDP growth of 2.8% and 5.3% was projected for 2021 and 2022 respectively).

March 2021 forecasts are more optimistic compared to those of December 2020, given the accommodative monetary policy and favourable financing conditions, as well as the massive fiscal policy support to businesses and households to ease the adverse consequences of the Covid-19 pandemic. The forecast relies on the assumption of the vaccination roll-out in line with the government plans. That would enable considerable easing of restrictions and improve economic agent sentiment in the second half of 2021.

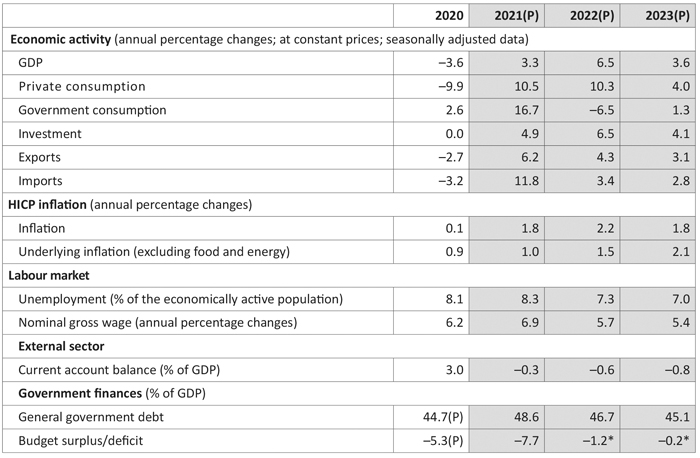

With economic growth and demand recovering both globally and in Latvia, commodity prices are on the rise and an increase in services prices is also expected. In view of the above, Latvijas Banka has also revised upwards the inflation forecast, i.e. to 1.8% and 2.2% in 2021 and 2022 respectively (compared to the December forecasts of 1.1% and 1.6% respectively).

For a more comprehensive account of the forecast underlying assumptions, see Latvijas Banka Macroeconomic Developments Report (currently available in Latvian; English translation will follow in due time).

Forecast underlying assumptions

At the close of 2020, the world saw the start of a massive vaccine roll-out; this has improved the expectations for the pandemic containment, global economic recovery and return to a normal life in the foreseeable future. The optimism, however, has been dampened by resurge of new Covid-19 infections and the emergence of new virus variants, as well as the differences in the vaccine roll-out progress. At the same time, the massive support of the major central bank monetary policy and government fiscal policies for mitigating the consequences of the COVID-19 pandemic crisis managed to reduce the economic slump in 2020 and will continue to support the growth this year as well..

In 2020, Latvia also saw a smaller-than-expected decrease in its GDP. This was a result of the favourable financing conditions and government support measures, as well as the strengthening economic resilience, with consumers and businesses being able to adapt to the crisis caused by the virus.

Factors affecting Latvia's economic development

The state of emergency was extended and restrictions were tightened in Latvia, therefore uncertainty remains high, weighing on investment decisions and, together with the adverse impact of the pandemic on employment and income, causing high consumer cautiousness. As a result of Covid-19-related restrictions, several services are still unavailable. Under such conditions, the level of savings will remain high in the first half of this year. Short-term data suggest that GDP was still seen decreasing even at the beginning of 2021. At the same time, government support for mitigating the adverse effects was also considerably expanded, and broader support also prevents unemployment growth. Unemployment forecasts remain close to the December estimates.

The overall GDP growth forecast for 2021 has been increased to 3.3%. Assuming that vaccination will proceed as planned, restrictions are expected to be reduced considerably from the second half of 2021, improving consumer and business sentiment. The fiscal measures supporting household income and more active spending of the precautionary savings and savings accumulated due the postponed consumption will be the factors behind the rapid recovery of the private consumption. On the one hand, high labour supply and limited financial resources of businesses prevent more rapid wage growth. Nevertheless, raising the minimum wage, increasing the wages of medical and teaching staff, short-term Covid-19 related bonuses for medical staff and one-off support payments supplementing the financial well-being of selected population groups also stimulate consumption. The rapid public consumption growth seen this year is related to the increased fiscal support for softening the crisis impact.

Investment decisions will be supported by the improving economic sentiment, as well as the financing of the Recovery and Resilience Facility (RRF) of the European Union (EU) will become available gradually. Export growth is estimated to move closely to the development of external demand, with Latvia's trade partners having addressed the crisis with smaller losses than the EU average last year and their economies rebounding from a better start position this year. Exports of goods registered growth already in the second half of 2020, and sentiment improvement will also gradually restore the flows of services hit by the restrictions. With the external and particularly the domestic demand improving, imports of goods and services will also see accelerated growth, and the foreign trade and current account balances will become negative.

February is likely to have been the last of the most recent months with consumer price deflation. Latvijas Banka's inflation forecast for 2021 has been revised upwards to 1.8%. This was mainly supported by the rising global commodity prices and service prices on account of pent-up consumption and higher per customer costs caused by the social distancing measures, as well as by the significant increase in the minimum wage implemented at the beginning of this year. Although neither the producer and import price developments nor the inflation expectations of businesses and consumers allow to project a steep rise in inflation, annual inflation could temporarily approach the presently rarely seen level of 3% in some episodes of 2021.

Government support helps to sustain the capacity of the supply side of the economy, preventing a wave of mass defaults and lay-offs. Hence, with the virus spread contained and demand rebounding, the economic recovery is likely to be more vigorous. According to Latvijas Banka's estimates, the announced government support measures to mitigate the consequences of the second wave of the pandemic that significantly increase this year's government deficit could contribute 3.5% to Latvia's GDP. While short-term income support can help to ease the fallout from the crisis, the government support should be focused on strengthening the long-term growth after the COVID-19 crisis through wise investment.

The strong recovery of the GDP growth and particularly that of the private consumption projected for the second half of 2021 is expected to continue in 2022 when the GDP is likely to grow by 6.5%. This will also improve employment opportunities and reduce unemployment. Investment growth will be further supported by both sizeable additional EU funding inflows, with increased support from the RFF, and improved private investor confidence. Rebounding domestic activity and service prices will keep the inflation growth steady at 2.2% and 1.8% in 2022 and 2023 respectively. Accessibility of EU financing will continue to sustain investment growth above the level of economic growth in 2023. At the same time, the build-up of pent-up consumption caused by the crisis will reverse and private consumption will follow the growth of the household income. GDP growth for 2023 is estimated at 3.6%. The projections of the general government deficit for 2022 and 2023 were made based on the assumption of a no-change government policy and considering only the already adopted government decisions. The EU fiscal rules have been relaxed during the present crisis to allow flexibility which will also be preserved in 2022. Therefore, the risks of a higher government deficit associated with the new policy initiatives, particularly with fulfilling the previously made promises, are high.

The short-term risks to the GDP and inflation forecasts are on the downside and mainly hinge on successful containment of the pandemic. If the vaccination does not proceed as planned and there are any delays in containing the spread of the coronavirus, including its mutations, the economic recovery is likely to be weaker and the upward effect of the pent-up consumption on service prices could be smaller than estimated. Nevertheless, the medium-term risks are tilted to the upside and a more vigorous rebound in global demand caused by the ample fiscal stimuli could provide an additional impetus also to Latvia's economic growth. Food prices could grow more than expected due to higher global demand, whereas the prices of industrial goods could increase more as a result of limited supply.

Table. Macroeconomic fundamentals: actual data and Latvijas Banka projections (P)

The cut-off date for the information used in the forecast is 16 March 2021, and 17 February for the information used in some technical assumptions.

Textual error

«… …»