Latvian transport sector. Long good-bye to the East-West transport corridor

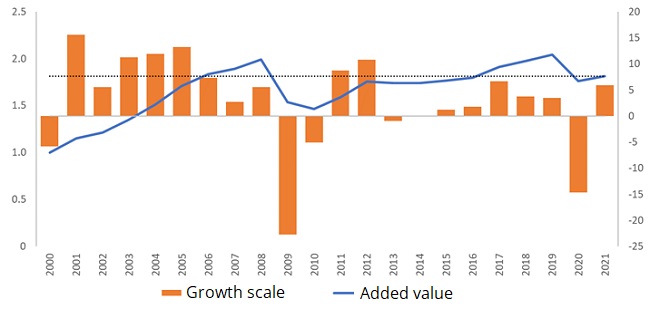

For more than a decade, the Latvian transport sector has developed very slowly, and its growth in actual added value has been very limited (see Chart 1). There are several reasons: continued decrease in transit flows, unsustainable increase in productivity, as well as the effects of the pandemic. Furthermore, the new geopolitical circumstances will make the sector slow down even more in the nearest future.

To respond to the Russian invasion of Ukraine, the EU and many other countries have imposed comprehensive sanctions on Russia and Belarus, and the Latvian transport sector is already affected by specific import and export bans. However, currently it is not yet clear what future sanctions will include, and whether the transport sector should prepare for a complete isolation of Russia. Irrespective of the long-term Russian transport policy and the objective to reorganise transit routes beyond Latvia, the volume of freight from Russia is still very important in the Latvian ports and railway carriage. At the moment, it is not yet possible to estimate the effects of the sanctions on the Latvian transport sector. However, it is clear that the sector has to forget about cooperation with Russia for a long period of time.

In short

-

For a sustained period of time, growth of the Latvian transport sector has been slow: the transit sector has gradually faded, and in combination with the effects of the pandemic, the added value in the sector has fallen to close to 2012 levels. The new geopolitical circumstances will also slow down growth of the sector in the nearest future.

-

In recent years, several sectors have rapidly grown, while the transport and storage sector has been one of the slowest growing sectors in the Latvian economy.

-

Gradual decline of the transit sector has significantly undermined the role of transport in the Latvian economy, and the contribution of this sector to the added value has slowly converged with the structure of EU Member States.

-

Since the beginning of this century, the Russian transport policy has focussed on developing an independent transport infrastructure. The re-routed transit consignments will only partially mitigate the negative shock in this sector, as sanctions against Russia expand.

-

Land transport and various auxiliary activities play an important role in the Latvian transport sector. Of late, the performance of both sectors has significantly improved, and they are affected by sanctions to a much lesser extent.

-

Postal and courier services have grown faster during the pandemic, although it has had a notable negative effect on the public transportation and air carriage flows. It is expected that as the pandemic alleviates and the epidemiological restrictions are eased, the passenger flows will return to the pre-pandemic levels.

-

In the nearest future, it may prove to be quite difficult or even impossible to rapidly increase cargo turnover, however, considering the new geopolitical circumstances it is important to find new opportunities and implement sensible solutions.

Chart 1. Actual added value in the transport sector, 2000–2021 (in comparative prices; 2000 = 1; growth in %; y/y)

To remind, the transport sector is an important and even irreplaceable component of other sectors, and ensures carriage of people and cargoes. The sector includes any and all transportation activities, as well as companies performing logistic functions and offering the transport infrastructure. The overall performance of the sector depends on the performance of other economic sectors, as well as the flexibility of transportation and carriage, efficiency of various carriage modes, loading and distribution capacity, geographical and other peculiarities. Furthermore, developed transport infrastructure and comprehensive transport and logistics system have an indirect effect on the development and competitiveness of other sectors.

Performance of the transport sector in Latvia: a retrospective

Historically, the transport sector has been very important for the Latvian economy, as due to location between the East and the West Latvia has been important in servicing transport flows and active engagement in international transportation chains. It has allowed for developing an extensive transport infrastructure in Latvia: an internal road network, three comparatively large ports with access to the Baltic Sea, as well as a rail connection with the CIS and Asia.

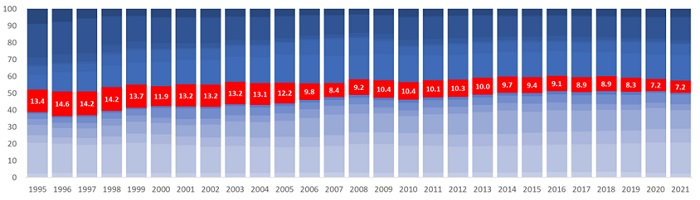

At the end of the 20th century, transport became one of the drivers of the economy and generated more than 14% of the total added value in the economy. However, now its role has diminished. Irrespective of the ever increasing demand for transportation and storage of goods and logistics services, growth of the transport sector has gradually slowed down. In 2021, the sector generated just 7.2% of the added value in the economy. As a result, the economy of Latvia has developed twice as fast as the transport sector (see Chart 2).

Chart 2. Added value in the Latvian economy 1995–2021 (% structure; in actual prices)

Such structural changes in the economy can be mostly explained by varying speeds in various sectors. Extraction and processing have grown the fastest of late, as well as information and communication services. Meanwhile, growth in transport and storage has been one of the slowest in Latvia. It was caused by several factors: little investment in transport and infrastructure, sustained deterioration in transit flows, weak multi-modal connectivity between various transport modes, obsolete procedures and stalling productivity. Furthermore, the pandemic has also had a significant effect on the transportation sector, disrupting the international supply chains and limiting passenger traffic.

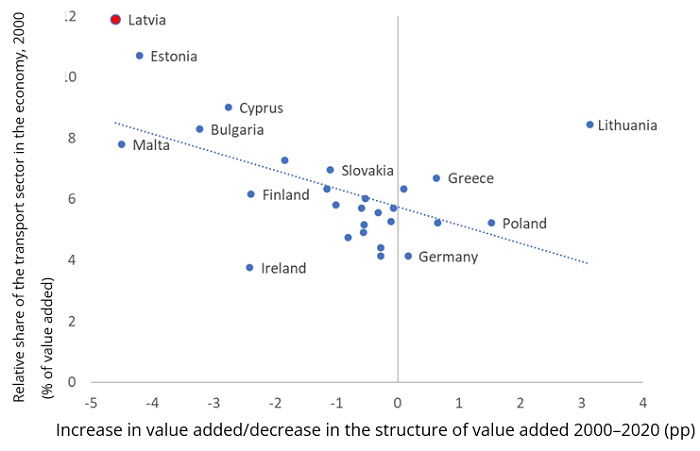

Situation in Europe: comparison

Historically, the Latvian transport sector has also had relatively sizeable added value among the EU Member States. 20 years ago Latvia had the highest contribution from the transport sector to the economy among EU Member States, but the situation has significantly changed since. Though growth has become much slower in the European transport sector during the last few years, and the contribution of transport has also decreased, the Latvian transport sector has contracted at a much faster pace. It can be explained by the weak sectoral performance and gradual phasing out of transit that has slowed down growth for sustained periods of time. It should be noted that all countries have structural and geographical differences that also affect the performance of the transport sector, although in general the EU transport sector contributes approximately 6% of the total added value that is on the average lower than in Latvia (see Chart 3).

Fig. 3. Relative share of the transport sector in the added value in 2000 and structural changes in the transport sector 2000–2020 (added value; %; decrease/increase; pp)

Lithuania experienced an opposite trend, i.e. the role of its transport sector has significantly increased during the last 20 years. The Lithuanian leap was made possible by the expansion of the land transport that contributes close to 70% to the total sectoral performance mostly due to increasing international road transport to the European markets. However, it should be noted that the Lithuanian road transport sector is plagued by several scandals involving illegal employment, human rights abuses and exploitation of immigrants.

It is expected that the recently launched Mobility programme will significantly change the current situation in road transport in Europe, including improvements in employment and social conditions of drivers. The Mobility package includes strict transportation conditions that will have a notable effect on cargo carriage in Europe and result in market reorganization. The long-term effects of the programme are not fully known, although it is expected that transportation costs will increase in the nearest future.

Transit flows via Latvia

In Latvia, transit mostly involves rail carriage. Almost 90% of all import rail consignments arrive from Russia or Belarus, and are destined mostly for the European market. The Latvian ports that handle, process, load and unload the consignments also offer a significant contribution to further transit flows. The largest Latvian ports have the technical capacity to prepare and ship various types of consignments via maritime routes. As a result, the transit sector is called a bridge between the East and the West.

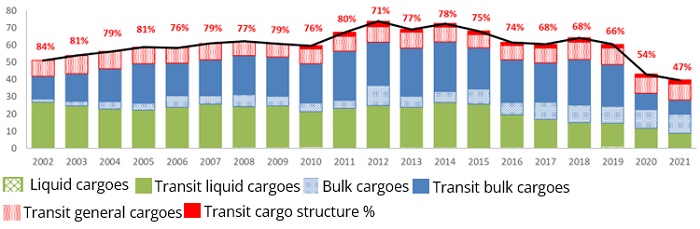

Still, the importance of rail and ports has significantly deteriorated of late due to the rapid decline in transit. For many years, the Russian transport policy has aimed to develop the national transport infrastructure to ensure logistics independent of the transit countries such as Latvia. Thus, the reduction in the volume of consignments has not been so much attributable to deteriorating accessibility by rail or sea, but the Russian reorganisation of transit routes. Until recently, the share of transhipped transit consignments in Latvia was 70–80%, but now this share has become relatively minor in all Latvian ports (see Chart 4).

Chart 4. Volume of transhipped consignments in Latvian ports* (millions of tonnes; distribution; %)

Targeted rerouting of Russian cargoes has made the Latvian ports look for other opportunities and find other directions that will mitigate the effects of the unavoidable sanctions against the Russian and Belarus transit consignments. As to coal transit, there were close to no such consignments via the Latvian ports in 2020: partly also due to climate neutrality aspirations that dramatically cut the demand for fossil energy in Europe. However, in some product segments, cargo interruptions are also expected in the nearest future. This mostly pertains to the Russian oil products that were already rerouted to the local Russian ports in Ust-Luga and Primorsk in the Baltic Sea.

Recovery of rail carriage in Latvia will depend on the new Rail Baltica project that will include Latvia in the new transport network with the Central and Western Europe. Furthermore, this project has become ever more important considering the current geopolitical situation. It is expected that railway could take over some road consignments, improve interconnectivity of various transport modes in the Latvian transport system and expand local and international passenger flows in the Northern-Southern direction. However, due to the sanctions a rail crossroad between Russia or a transition point between two rail gauges no longer seems feasible in Latvia.

Transport sector by turnover

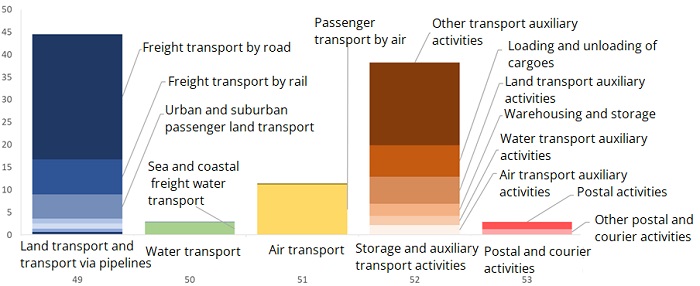

The performance and long-term development of the transport sector are based on the capacity of transport as a system, but the transport sector is very large. The totality of all components and their interaction are quite unclear, thus, the importance of individual transport modes in the economy is often overvalued. Road transport is the most significant, as well as storage and transportation auxiliary activities. Both sectors drive the overall performance and contribute more than 80% to the total sectoral turnover. Meanwhile, water transport, postal and courier services have a relatively minor role as their total turnover is only 5–6%.

The land transport also includes passenger and cargo carriage by road or rail. Judging by the type of economic activity, road transport plays the most significant role. Road transport is one of the domains that has managed to significantly increase the capacity and the volume of transported goods during the last few years. This development is mostly attributable to international cargo carriage. The volume increased due to efficient operations in the European markets where the competitiveness of Latvian carriers has gradually increased. On the other hand, rail carriage has deteriorated as the volume has been systematically shrinking for many years. It should be noted that in this subsector the effects of sanctions on the Russian and Belarus consignments may not be as noticeable as for the rest of the transport sector, since the railway is not as important for the economy as has often been claimed.

The land transport also includes taxi services and individual cargo and passenger services. These sectors have a very minor role in the Latvian transport sector as the above activities are rarely regulated or controlled, and the share of grey economy in these sectors is high. This is one of the causes of poor performance (see Chart 5).

Chart 5. Turnover by economic activity, 2019 (structure; %)

Storage and auxiliary transport activities have an important role in the transport sector. This domain includes various activities that are related to the transport infrastructure and cargo handling, processing and loading, as well as logistics agencies. This sector creates and prepares everything that may be needed to carry cargoes. It also includes ports that mostly only load ships and are almost never engaged in shipping.

From the point of view of economic activity, other auxiliary transport activities play an important role in the sector. They include organising and completing transportation operations, pulling together and processing consignments, drawing up transportation documentation, expedition and agency, as well as handling various types of goods. This sector boasts impressive productivity and creates a major share of the added value in the transport sector.

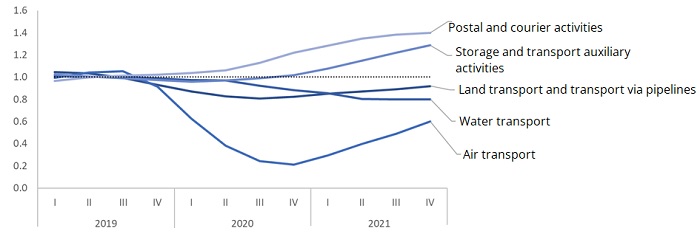

The Covid-19 pandemics caused a negative shock in all sectors of the economy, although some sectors were able to adapt, but others could not recover for long periods of time. The attempts to limit the spread of the virus, as well as restrictions significantly affected the air carriage and public transport. In 2020, the urban and suburban passenger flows decreased by almost 1/3, while the number of air passengers by approximately 3/4. The effects of the pandemic were the most notable in air carriage that is the third largest subsector in the Latvian transport sector. The air traffic has a strategic and integral role in the economy, as the speed of travel offers significant advantages. And the longer the trip, the more benefits. However, the pandemic also highlighted its largest drawbacks such as high running costs, capital and resource intensity.

It is important to underline the potential of air carriage considering the plans to develop a multi-functional cargo logistics centre near the airport and Rail Baltica connectivity with the Latvian air transport system. It is expected that traveller flows and numbers will increase in the nearest future as the effects of the pandemic alleviate and the restrictions are lifted. However, proximity to regions with active warfare and closure of the Russian air space create new challenges requiring a longer period of time for the added value to recover to the pre-pandemic levels.

Postal and courier services have developed very rapidly during the last couple of years. Many innovations and technical solutions have been introduced in the sector. Furthermore, the pandemic made this sector develop much faster than before. However, the share of postal and courier services is very small and has close to no impact on the overall performance of the transport sector (see Chart 6).

Chart 6. Turnover indices of the transport sector by quarter (s.a. index; 2019=1)

After an assessment of the current and expected events in the transport sector, the effects of the pandemic and the forthcoming geopolitical challenges, it is important to note that it will not be possible to rapidly increase the turnover of consignments in the nearest future. Thus, it may be quite difficult or almost impossible to fully use the transport infrastructure and increase the workload in the nearest future. As new geopolitical circumstances transform international trade and as the supply chains are reorganised, the sector should be given new opportunities and solutions for the future. The ever increasing environmental and climate targets also result in additional strain for the sector considering its emissions profile. However, duly introduced measures may contribute to transportation efficiency as implementation of various innovations and digital solutions may contribute to the sectoral performance in the long term. Thus, it is important to introduce sensible solutions in the nearest future.

Textual error

«… …»