Interpreting the unknown in the "coffee grounds" of manufacturing data

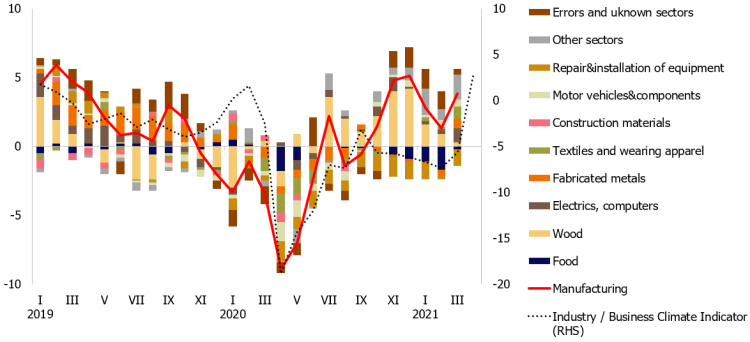

In the first quarter of 2021, the performance of manufacturing was weaker than at the end of 2020 recording a quarter-on-quarter decline of 0.3%. The weakening performance was particularly noticeable for the manufacture of food products and beverages which may have been more directly affected by the restrictions imposed on stores and catering establishments. Moreover, several industries faced shortages of raw materials and components as well as issues with the availability of freight containers. This, in turn, affected production volumes and costs. Problems were observed in metalworking and mechanical engineering, wood industry, manufacture of electronic and electrical equipment, etc.

Despite some weakening in the first quarter, overall the manufacturing industry withstood the storms during the second wave of the pandemic fairly well. Manufacturing is still strongly supported by the wood industry, printing, chemicals and, particularly, the manufacture of furniture (in Chart 1, printing, chemicals and furniture are included in the category "other known sectors"), as well as by sectors undisclosed due to the dominance of large businesses. We can estimate the performance of these unknown sectors by calculating the difference between the overall manufacturing output and the output of all known sectors. Already since the end of 2020, these sectors have provided considerable positive contribution to manufacturing, leaving room for speculation as to the fastest-growing sector. The undisclosed sectors (manufacture of pharmaceutical products, manufacture of electronic products and manufacture of other transport equipment) together account for 11% of the manufacturing output.

Data restrictions urge us to step out of the usual framework of our excel tables and to search for answers elsewhere. This makes analytics more interesting, albeit also more speculative. Let us interpret the data like fortune-tellers interpret coffee grounds!

Demand for the manufacture of computer and electronic products remained relatively resilient. However, the availability of product components has been problematic due to a global shortage of microprocessors. Thus, the sector's performance may well have been good, but it is unlikely to have improved significantly. Manufacture of other transport equipment, construction and repairs of ships in particular, is also unlikely to have seen strong growth as demand in this sector may have been limited due to the pandemic.

It should be noted that the manufacture of pharmaceutical products, Grindex Group in particular, is the main contributor to the good performance of the unknown sectors. According to publicly available information, in 2020 Grindex Group recorded record-strong growth in terms of its turnover and profit.

ts turnover amounted to 187 million euro, representing a 32% increase year-on-year, while its profit surged by an impressive 42%. Grindex Group intends to increase its turnover by another 19% in 2021. Therefore, we can reasonably expect good performance in the first quarter. The Group takes pride in its buoyant growth in new markets and its consolidation in the existing ones. Moreover, it has great plans for the future, as it is considering the construction of a new pharmaceutical plant in Latvia with 800–1000 new jobs.

Overall, it can be concluded that manufacturing is facing plenty of challenges and obstacles; nevertheless, it is still able to pleasantly surprise analysts and challenge their hypotheses. Restrictions are being eased gradually and the industrial sentiment indicators are improving: in April, optimism has increased greatly in both manufacturing and other sectors giving us hope for good performance in summer.

Chart 1. Manufacturing output (year-on-year; %; contribution; percentage points) and industrial sentiment (%)

Textual error

«… …»