Households grow accruals

As economic growth accelerates and compensation rises, both consumption and bank deposits – and thus the general standard of living are growing. For a fifth consecutive year, the annual growth rate of household deposits is positive, and, since 2014, it has been consistently exceeding economic growth rate.

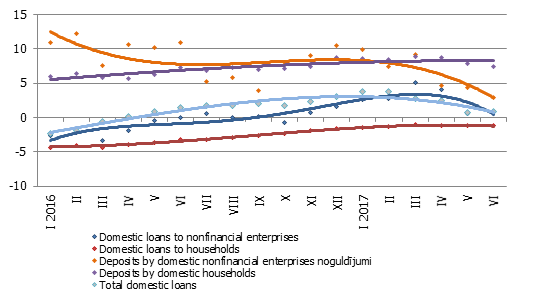

Household deposits increased also in June, and their monthly growth rate was the fastest this year, Even though the annual growth rate of loans is still lower than in the first months of the year and the amount of newly granted loans is lower year-on-year, the growth of the balance of loans granted to nonfinancial corporations in June has been the fastest this year. The total domestic loan portfolio has increased as a result.

The domestic deposits attracted by banks increased in June by 0.8%, with their annual growth rate at 2.1%. The deposits of nonfinancial enterprises meanwhile grew by a mere 0.1% (annual growth rate at 2.9%), whereas household deposits increased by 1.3% (annual growth rate at 7.5%).

Even though domestic deposits were on the rise, the deposits of other euro area residents dropped in June, bringing down the Latvian contribution to the euro area money supply indicator M3 (by 1.2%; annual growth rate at 2.4%). Overnight deposits with Latvian credit institutions by euro area residents dropped by 0.4% and deposits of maturity of up to two years by 8.5%, whereas deposits redeemable at notice increased by 0.6%.

The total balance of domestic loans increased by 0.3% in June, including by 0.4% of those granted to nonfinancial enterprises and by 0.2% of consumer loans granted to households. The total household loan portfolio, on the other hand, contracted slightly as the balance of housing loans diminished. The annual rate of change in domestic loans was 0.9% in June (0.9% in loans granted to nonfinancial enterprises and –1.2% in loans granted to households).

Annual changes in some financial indicators (%)

The prospects of economic growth and advantageous financial conditions allow us to predict stability and moderate growth of monetary indicators in the coming months of this year as well. Consumer confidence, prospects of the real estate market and desire to purchase hard goods will foster recovery of household lending. Evidence for this was the survey conducted in June by Latvijas Banka on the trends in lending growth in the second quarter of 2017 and predictions for the third quarter (half of Latvian credit institutions surveyed predicted that household demand for housing purchase loans and consumer loans will increase in the third quarter). Changes in enterprise demand for loans, however, are not expected according to the survey data, On the other hand, if the uptake of European Union funds will activate in the second half of the year as predicted, that could speed up growth in lending to enterprises.

Textual error

«… …»