Household deposits with banks rose in April

Money supply indicators increased in Latvia in April: both the Latvian contribution to the total euro area money supply M3 and, on account of household deposits, the total domestic deposits. The drop in the domestic loan portfolio was negligible and practically did not differ from that observed in the previous month.

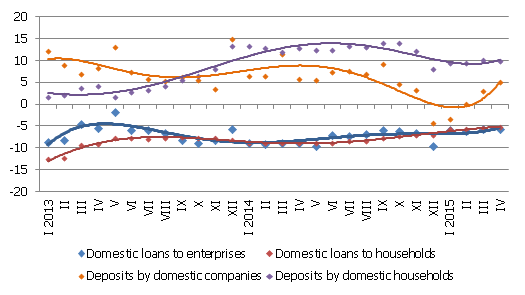

In April, the total balance of bank attracted deposits increased by 0.6%, thus the annual growth rate reached 7.4%. The deposits of households increased by 1.3% month-on-month, exceeding the indicator of April of the previous year by 9.8%. The deposits by non-financial enterprises in April dropped by 0.7% and their year-on-year growth was 5.0%.

Turning to the changes in Latvian contribution to the euro area common money indicator M3, the euro area residents' overnight deposits with Latvian credit institutions in April rose by 0.5%, deposits with the maturity of up to two years by 1.2% , and deposits redeemable at notice by 2.4%. Since the amount of cash currency in circulation increased slightly in April, Latvia's overall impact on the euro area money supply was positive: its contribution to M3 increased by 0.6% month-on-month and exceeded the level of the corresponding period of the previous year by 8.3%.

The domestic loan portfolio of banks dropped in April by 0.2%, including the loans to non-financial companies decreasing by 0.6% and loans to households by 0.4%, whereas loans to financial institutions increased. The annual rate of decrease of domestic loans remained almost unchanged and was 4.4% (5.7% for loans to non-financial companies and 5.2% for loans to households).

Year-on-year changes in some money indicators (%)

Source: Latvijas Banka

The rise in attracted household deposits indicates that the rising income not only allows for active shopping, which is borne out by the rise in the retail turnover in the first quarter of 2015, but also put away money for the future. Even though the bank accounts of entrepreneurs emptied slightly in April in pace with the slowdown in economic growth, the trend of rising deposits continues overall and, year-on-year, deposits are expected to grow in the subsequent months as well. In absolute numbers, the rise in the deposits of the inhabitants will be more stable, whereas enterprises will experience shifting month-to-month rises and drops.

Although banks admit that they would be ready to lend for quality projects of enterprises and lending resources are becoming ever cheaper and accessible to banks (lending also being boosted by the Eurosystem programme for purchasing state sector securities), both banks and enterprises proceed with caution after assessing their risks. Yet over the year we can expect a small rise in the demand for loans both by enterprises and households, but the demand of households will be related to amendments to legislation and the participation of the biggest banks in the state support programme for purchase of housing. Some banks have also announced an increase in the amount of newly granted loans, therefore we can predict that the drop in the total loan portfolio of the banking sector will continue to slow down.

Textual error

«… …»