Has the manufacturing output already bottomed out?

The eagerly awaited data on the manufacturing output for April have been published. There was no doubt that the decline in April would be steep. The question was: how steep? Thus the final bill to be paid by manufacturing to civd-19 looks as follows: -5.9% month-on-month (seasonally adjusted data) and -9.0% year-on-year.

Clearly, such a decline is not insignificant, and it will take more than a quick fix to ensure the sector's recovery. The government has implemented various support measures, e.g. furlough benefits, tax repayments, quicker VAT refunds, loan guarantees, etc. However, the main burden fell on the shoulders of the manufacturing businesses and their employees as the businesses were adjusting their assortments of goods, looking for new markets, searching for compromises to lower costs and competing for market shares domestically or in export markets where they faced even fiercer competition. Different subsectors and businesses handled the crisis with various degrees of success.

Almost all manufacturing subsectors recorded significant output declines. The only exception was the chemical industry whose production output soared like a popping champagne cork. This was most likely due to a high demand for disinfectants. In addition, some expansion could also be observed in printing and manufacture of electrical equipment.

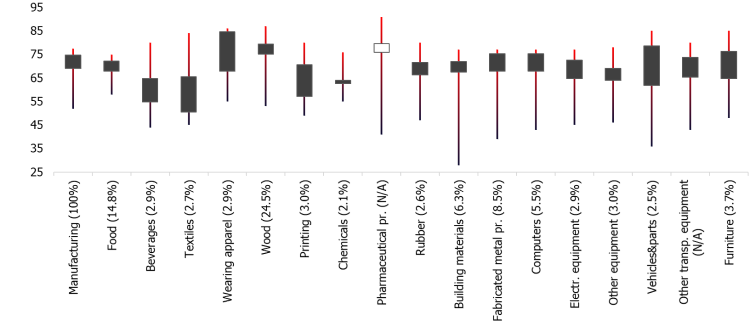

Output declines were already expected in almost all sectors, and they were also suggested by the capacity utilisation dynamics implied in industrial confidence surveys: in the second quarter, all subsectors but one saw their capacity utilisation decline quarter-on-quarter (see Chart 1). Manufacture of pharmaceutical products was the only subsector to record higher capacity utilisation quarter-on-quarter (specific results are not indicated due to confidentiality considerations/dominance of large businesses in the subsector). Meanwhile, manufacture of parts of motor vehicles saw the sharpest decline. This is no surprise, since the respective Latvian businesses had already reported downtime on account of production disruptions in large automotive plants in Europe.

Chart 1. Capacity utilisation in the second quarter of 2020 (quarter-on-quarter; percentage points) and variance since 2004 (weighted against 2019)

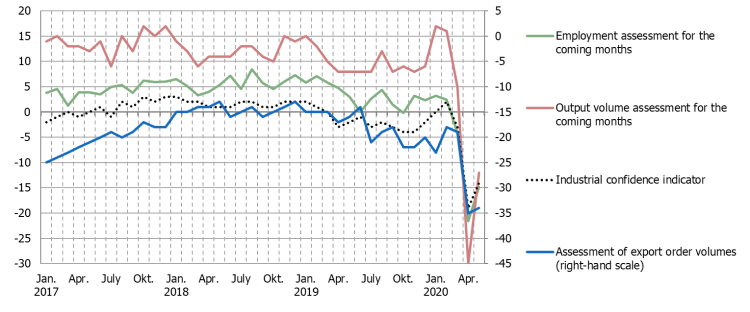

In May, the manufacturing output could already show some improvement month-on-month; however, it is expected to remain at low levels in year-on-year terms. These developments are suggested by the changes in the industrial confidence indicator (see Chart 2) as well as the assessment of the representatives of industry associations regarding the gradual lifting of restrictions in export markets and the resumption of production in Europe's factories, inter alia those of the automotive industry. If the situation, at least to some extent, returns to the "good old days" over the summer, we will still be reminded of many other obstacles to development that are unrelated to the current Covid-19 crisis. For instance, after hibernation in mild winter conditions, bark beetles will be full of energy to resume their misdeeds in the forests and, thus, they are likely to cause problems for the wood and logging sectors. See you in May! Or, rather, in July when we will look at the May data.

Chart 2. Industrial confidence indicator and select survey questions; %

Textual error

«… …»