In goods export, Russian shadow gradually shrinks

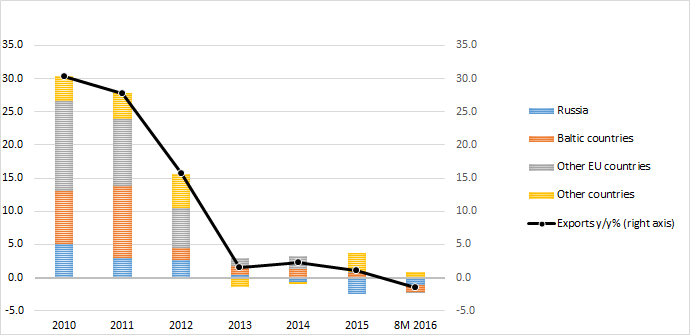

Total Latvian goods exports increased by 1.1% in 2015, which should be considered a good performance, given the embargo Russia has placed on food and the complicated and unfavourable situation in several of Latvia's export markets. Unfortunately, this year Latvian foreign trade indicators are mostly found in the negative zone and in the first eight months of the year, good exports have dropped by 1.5% year-pn-year (Fig. 1).

Figure 1. Contribution of trade partners to Latvian goods export growth (p. p.)

In the embrace of prohibitions and sanctions

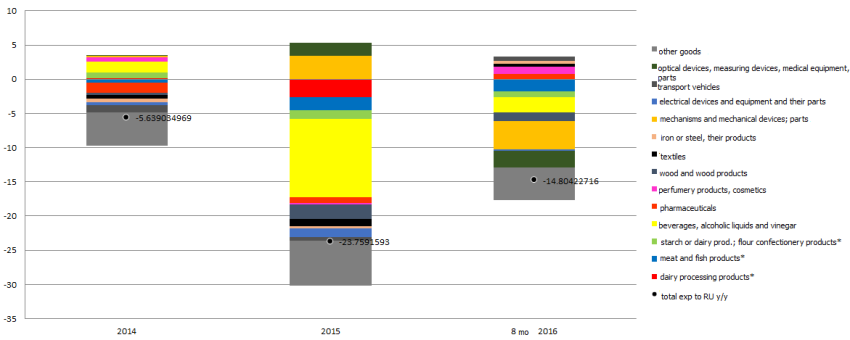

There is no doubt that the total growth of Latvian export goods in 2015 was substantially curtailed by the drop of exports to Russia which dropped by 24% year-on-year. Yet goods exports to Russia were not diminished only by the consequences of the embargo placed by Russia on 7 August 2014 on beef, pork fruit, vegetables, fowl, fish, cheese, milk, dairy products and the unlimited prohibition against the entire exports of Latvian fishing products to Russia announced on 4 June 2015.

In 2015, only about one third or 28% of the drop in goods export to Russia was accounted for by the drop in the export of prohibited products, including dairy products by 11% and fish production by 8%. In 2016, this proportion shrank to 26%, including dairy products by 0.4%, and fish export production by 17%.

Figure 2. The contribution of goods groups to export growth to Russia (p. p.) and nominal export to Russia (y/y %)

*the prohibited foodstuffs belong to these groups

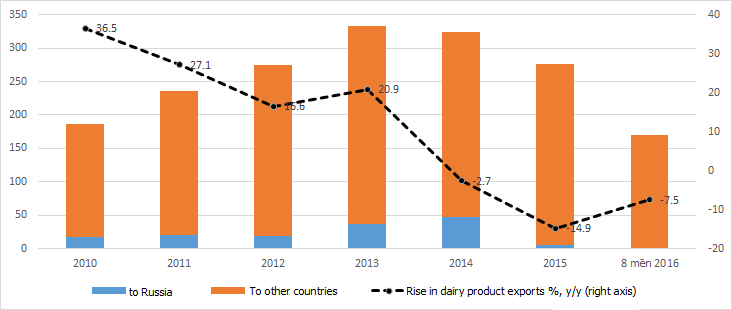

In the context of sanctions placed by Russia, the dairy industry and fish industry are the branches mentioned most often. In 2013, about 11% of milk processing products were exported to Russia. Already beginning in 2014, the total exports of dairy products began to shrink (Fig. 3). Despite the overall drop in dairy products exports and the fact that the sanctions were introduced in August 2014, the exports of dairy products to Russia grew in 2014, exceeding the indicator for the previous year.

This has to do with the fact that at the beginning of 2014 the demand of our large neighbour for milk, cream, butter, cheese and cottage-cheese increased substantially at the beginning of the year and as a result the exports of processed dairy products to Russia grew substantially in the first seven months of the year, almost thrice exceeding those in the corresponding period in 2013 and compensating the drop in the months following the embargo. In fact, it is 2014, which began to mark prospects of an expanding export market for the dairy branch in Russia, opening up possibilities to substantially increase the exports of milk products. The sanctions, however, did away with those possibilities.

Yet the 8% year-on-year drop in global milk prices and weaker demand for dairy products in other European Union (EU) countries had more of a negative impact on the dairy branch in 2014 than the Russian embargo. In 2015, the consequences of the Russian prohibition were the greatest negative contributor to the exports of dairy products and, additionally, the dairy branch continued to be negatively affected by the drop in global milk prices (by 25% year-on-year), as well as lifting of the EU milk quota system from 1 April 2015. This year, too, the problems with dairy product export continued as it was adversely impacted both by the continued dropping global milk prices and the overproduction of dairy products in the EU market.

Even though new export markets are being actively sought for dairy products, the relatively small Latvian production and export volumes are an obstacle in achieving better conditions and more advantageous prices in foreign markets. In the first eight months of this year, the export of dairy products was 7.5% lower year-on-year (Fig. 3). The acquisition of new export markets is not happening so quickly and successfully as to ensure stability of the market and quickly compensate the exporters of dairy products for the drop in Russian demand. According to the report prepared by the Ministry of Agriculture (AM), in the period from January 2015 to June 2016, dairy product export was launched to 20 new markets, yet not all of these markets are still active. According to the data of the Central Statistical Bureau (CSB), a positive contribution to dairy product export in the first eight months of this year was ensured by exports to Bulgaria, Poland, the Czech Republic, Belgium, Afghanistan, Saudi Arabia, Romania, Finland, Jordan, Great Britain, the United Arab Emirates (UAE), Japan etc.

Figure 3. Exports of dairy products, mil. EUR

While the Latvian dairy product manufacturers are adjusting to the situation and patiently looking for new markets in order to compensate for the lost opportunities in the Russian market, new problems have arisen: low prices and overproduction in the EU countries. Given the weak demand in the EU countries, increasingly more entrepreneurs are moving their business to the Asian markets; new markets are also found in the Balkans and elsewhere in Europe.

The fish industry was 'most loudly' impacted by the open-ended prohibition, announced on 4 June 2015, against all Latvian fishing industry exports to Russia. Yet even before this prohibition, the exports to Russia of canned fish (incl. sprats) had dropped since 2013. The exports of canned fish in total Latvian exports is negligible, amounting to 0.7-0.8%. For several years, the exports of canned fish to Russia amounted to 0.3% of total exports, and, at the beginning of 2015, just before the prohibition was introduced, it had dropped to 0.1%. In view of the negligible percentage of fish products in total exports, the Russian prohibition has no crucial effect on total Latvian goods exports, even though, as far as each particular company is concerned, losing the Russian market meant substantial losses to them.

Latvian fish product manufacturers have no illusions that the relationship with Russia will improve in the next few years, and that is why almost all fish processing enterprises also have markets outside Russia and the customs union countries. Latvian producers export their fish products to over fifty countries. Currently, enterprises are taking part in various international exhibitions and are testing the demand and market in such countries as the US, Canada and even Australia.

According to the Ministry of Agriculture information, starting in early 2015, exporters in the segment of frozen fish have tried to launch exports to 10 new markets, yet only in Serbia they have succeeded to maintain continuous sales. The canned fish segment has tried to acquire eleven new markets, including China, Egypt, Hong Kong, Macao, Mexico, New Zealand, Somalia and others, but consumer interest has remained steady only in four of them.

Despite many problems, new markets are still being conquered, as evidenced by the approved veterinary certificates: 23 in each, 2015 and 2016, including for dairy products to Iraq, Mexico, UAE; fish products to Montenegro; meat and meat products to UAE, Kosovo and Australia.

Just as in the dairy sector, the conquering of new export markets for Latvian fish production is not quick or easy, nevertheless statistics indicate that in the export of fish products and canned fish, exporters have almost managed to compensate for the loss of the Russian market: after a 9% drop in 2015, the exports of fish products in the first eight months of this year have increased by 11% year-on-year.

Problems of the Russian rouble and the drop in demand is reflected in Latvian export

In addition to the sanctions established against food products, the growth of goods exports was adversely affected by the drop in the exchange rate of the rouble. Altogether in 2014, the Russian rouble lost about half of its value against the world's largest currencies, the dollar and the euro. Combined with the high inflation and high interest rates, the drop in the value of the rouble substantially reduced the purchasing ability of Russian residents and that had a negative effect on the functioning other branches unaffected by the embargo, for instance, the pharmaceuticals and textiles manufacturers exporting from Latvia.

The pharmaceuticals branch is to a great extent oriented toward export and the most important markets for it up to now have been Russia and the other Commonwealth of Independent States (CIS) countries, followed by the Baltic neighbours and other Eu member countries. The proportion of Russia in the exports of pharmaceuticals dropped from 29% in 2012 to 15% in 2015 to 13% in the first six months of this year.

The drop in the export of pharmaceuticals to Russia began already in 2014, primarily as a result of the fast shrinking rouble. In 2015 as well the export of this group of good continued to drop. This year, a slight increase has been observed in the export of pharmaceuticals to Russia: 5% more than in the first six months of last year. Altogether, pharmaceutical exports in the first six months of the year have increased by 28% year-on-year. It indicates that the exporters of medical supplies have managed to rather successfully reorient themselves to other markets and to increase sales in the existing ones.

In spite of geopolitical risks in the east, fluctuations in exchange rates etc., Latvian manufacturers and exporters of medicines, are not considering the possibility of decreasing their presence in the markets of eastern countries but are trying to maintain the extent of it in some countries, increasing it in other CIS countries.

Increasing efforts are being invested to acquire the markets in Central and Western Europe as well as Asia. A good example is AS Olainfarm, whose exports to Russia at one time accounted for 90% of turnover, whereas now they account for 38%, and at present, Olainfarm products are being exported to 40 countries, including, very recently but in growing amounts to Albania, Mongolia, Tajikistan and Turkmenistan.

The second largest Latvian pharmaceuticals concern Grindeks, owing to its business diversification strategies and expansion of activities in new markets, has achieved a 20% increase in its sales volumes year-on-year. Despite the fact that, having assessed its currency risks, Grindeks curtailed its activities in the Central Asian countries, it achieved the greatest increase in sales in the first six months in Russia (25%) and other CIS countries - Uzbekistan (18%), Moldova (17%) and Turkmenistan (15%).

Another branch that is rather often mentioned as a victim of the weak exchange rate and the drop in Russian demand is the textile branch, which used to have an important market in Russia. In 2014 Russia was the fourth largest export market for textiles, but, as a result of the reduced demand, the Russian proportion as a textile export market diminished from 7.4% in 2014 to 5.1% in 2015, pushing Russia in seventh place, below such countries as Estonia, Poland, Sweden, Lithuania, Denmark and Germany.

I should also note that export of textiles last year and also this year has suffered most from the drop in exports to Estonia, which has been and still is the first and largest market for Latvian textiles. After a substantial drop, as of mid-2015, the export amounts have stabilized and exports even to Russia are not continuing to drop. It is a good sign that in the textile branch too there are enterprises that do not give in to depression and are exploring new varieties of business. For instance, Lauma Fabrics has found new possibilities of growth in geotextile, 100% of which will be exported to Poland, Italy, the Netherlands, Scandinavia and other European countries.

It is no secret that about 1/3 in Latvia's export structure to Russia is taken up by beverages, spirits and vinegar. It is the drop in alcohol exports (by125.7 mil. EUR in 2015), which has had the greatest negative impact on the decline both of food industry products and overall exports to Russia (Fig. 2) in 2015. Alcohol has not been listed as prohibited, but the drop in its exports resulted from the falling value of the rouble and weaker demand as well as from reduced re-exports. The decline in the sales of alcohol in the Russian market was compensated this year by increased sales in other markets, mostly in already existing ones.

China: an alternative to Russia?

In relation to the lost Russian market for dairy and fish products, China has been mentioned. The traditional export products to China have been wood (40-45% of total exports to China), electrical equipment and electrical appliances (11-15%), mineral products (10-16%), copper and copper products (~10%) and furniture (~3%).

The main agricultural product with which Latvia has been steadily supplying China is blueberries; in 2014 this product accounted for 84% of the export value of all agricultural and food products.

In the last two years, other foodstuffs and agricultural products have appeared in exports to China, including dairy and fish products. In May 2015, Latvia began exporting dairy products (ice cream) to China. At present, the percentage of dairy and fish products in export to China is very small, yet it has a tendency to increase. The vast Chinese market offers wide opportunities for growth and the certificates obtained by several enterprises for selling dairy and fish products in the Chinese market represent a stimulus for the development of dairy exports.

Entrepreneurs that have already ventured into the Chinese market admit that China is a completely new and specific market for Latvia in the area of food and that entering this market is not simple because the local traditions and the specifics of the business environment have to be taken into account, differing cardinally as they do from Europe. Entering this market will therefore not be quick or easy as borne out by statistics, which do not point to a fast export growth to China.

Better short term results in the Chinese market have been posted by canned fish exports, which, in the first eight months of this year, have by 67% exceeded last year's total. The dairy exports to China have likewise increased, albeit slower than those of canned fish. The Chinese-certified Latvian enterprises are allowed to export cheese, milk powder, cream and ice-cream. The Chinese, however, are cautious in consuming our milk and cheese, therefore the milk processors have to develop products specifically for the Chinese market.

The hopeful opinion of some enterprises voiced in some mass media point to cooperation and dairy product possibilities. For instance, the leading Latvian dairy processing enterprise Food Union can take pride in some tangible results in the Chinese market and, after launching ice-cream export, it has taken the second logical step in conquering that market.

As of June of this year, Food Union has supplemented its ice-cream exports to China with regular exports of milk, securing its positions in the shops of Shanghai. Next year, the enterprise expects to diversify its export portfolio with the exports of yogurt, cream cheese and other dairy products. Food Union has also placed a cornerstone for its factory in China, which it expects to complete in June 2017. In the future, it could be positively reflected also in the exports of dairy products, for the factory will need raw materials.

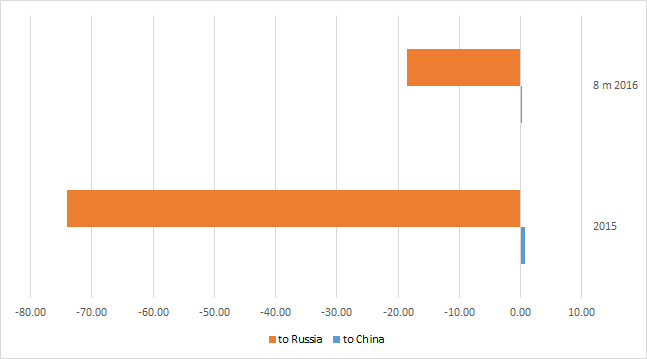

Figure 4. Y-y rise in the exports of agricultural and food products, except alcohol, beverages and tobacco products (mil. EUR)

Data indicate that in the course of a year-and-a-half, export or agricultural products and foodstuffs to China falls much short of compensating for the loss of exports to Russia. In 2015, the export of agricultural and food products to China grew by a mere 0.8 mil. euro and, in the eight months of 2016, by 16 thousand euro, which is much too little as far as compensating the drop in this same group of goods in exports to Russia – respectively by 74 million euro in 2015 and by 19 million euro in the first eight months of 2016. (Fig. 4)

We can therefore conclude that the Chinese market is no panacea with which the Latvian producers could compensate for the lost export opportunities to the Russian and other markets. Furthermore, the majority of Latvian food enterprises lack sufficient production capacities to be able to export products in sufficient quantities for mass consumption in large markets.

One of the courses several enterprises are already following to conquer the Chinese market is specializing in innovative products and developing new products. Given the ecological and quality problems in the industrial countries, including China, consumers are increasingly adopting healthy lifestyles. The Latvian producers in this area are in a good position to use this trend and ensure long-term consistent export opportunities to China and other Asian countries.

Conclusion

Latvia's foreign trade ties to Russia are becoming ever weaker: the Russian proportion in Latvia's total good exports has dropped substantially – from 11.6% in 2013 to 6.9% in the first eight months of 2016.

There are several reasons for this drop: the Russian embargo on food products; the significant drop in the exchange rate of the Russian rouble and the weakening of the demand in the Russian market. Therefore, a drop is observed in almost all groups of goods exported to Russia.

Even though the negative impact of Russian sanctions on the export of agricultural goods and foodstuffs has diminished this year and is not fostering an additional drop in the export of the sanctioned goods, the agriculture sector has yet to fully compensate for the lost export opportunities in the Russian market. Along with a loss of the Russian market, competition has grown keener in other partner markets and the word 'crisis' is often mentioned in the comments by entrepreneurs and economists. Yet it has also been noted that in Chinese the word 'crisis' is written with two hieroglyphs of which the first means 'danger' and the other 'opportunity'. It is therefore important to remember that any (economic or political) crisis is another stimulus to countries, branches and enterprises to come up with new models for their operations in order not just to survive but to improve their competitiveness. As our poet Rainis had it: 'Only that which changes will live!'

Textual error

«… …»