Financial Stability Report 2020

The latest Financial Stability Report discusses the major trends of Latvian financial system development and the issues concerning financial system resilience:

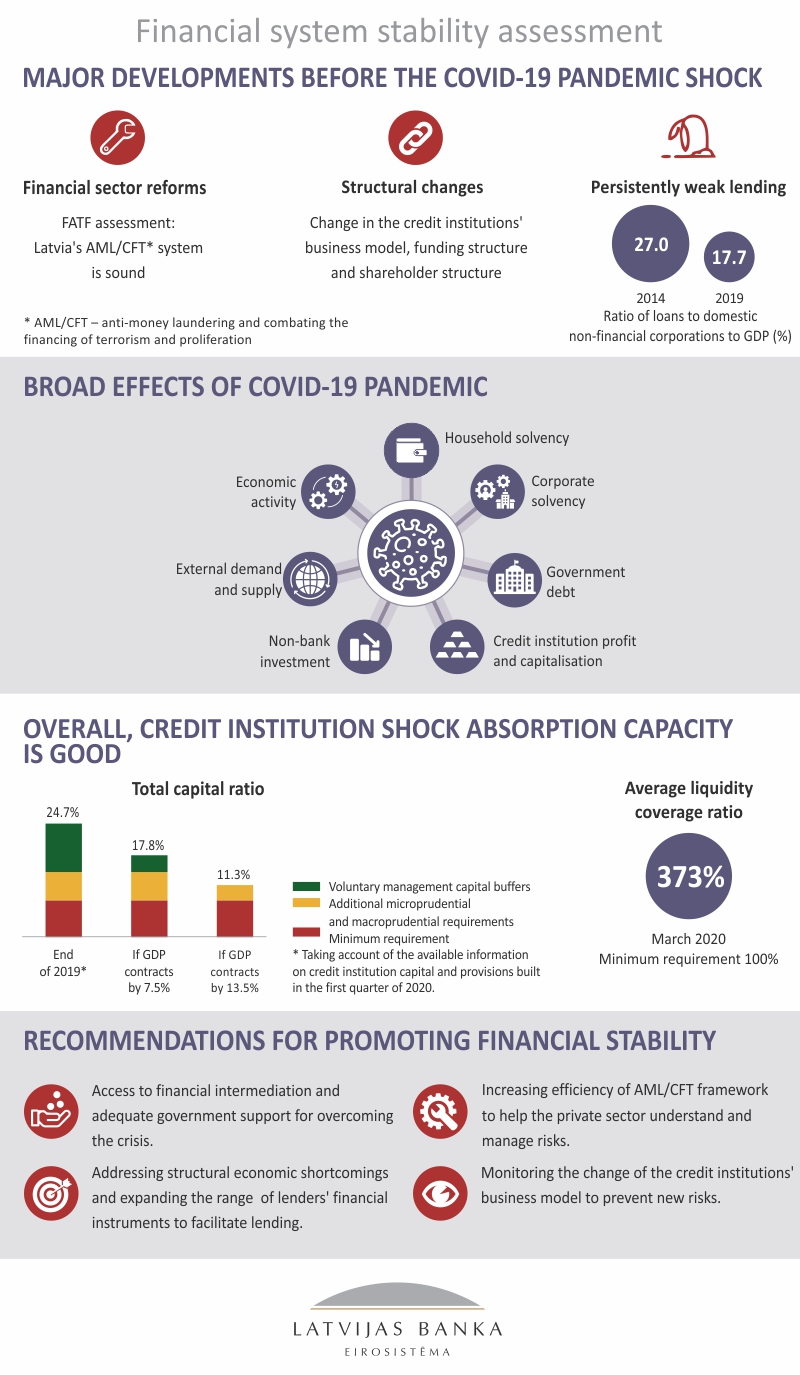

- The COVID-19 pandemic and its containment measures are an unprecedented shock to the global and Latvian economy and financial system with broad impact, but Latvia's credit institutions' capacity to absorb shocks is good as their capitalisation and liquidity reserves are sound overall.

- Contrary to the 2008 crisis, Latvia's financial system and its economy are much more resilient. A significant difference is Latvia's participation in the euro area which provides additional stability and security.

- Lending to domestic businesses has been persistently weak due to both demand and supply factors, inter alia structural economic shortcomings.

- Ambitious AML/CFT reforms have been implemented, Latvia's financial sector has been experiencing notable structural changes.

- The Report also discusses new macro-prudential measures and a new tool for cyclical risk assessment, change of credit institutions' business model, non-bank sector developments and cybersecurity risks and climate change related risks.

x

Textual error

«… …»

Report error to the website editor