Elevated inflation in Latvia: what to do and what not to do now?

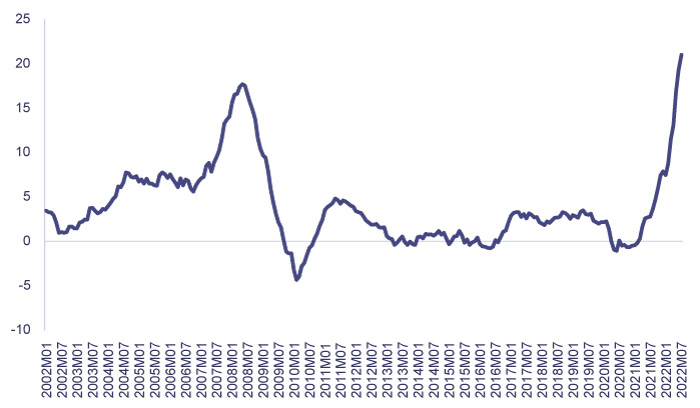

The price level in Latvia has climbed very steeply since last summer. The flash estimate of inflation for July shows that the current price of the average consumer basket has grown by 21% year-on-year. Such steep price rise affects everyone; furthermore, it is particularly felt against the backdrop of the last decade when the inflation rate, on average, only slightly exceeded 1% per year.

Inflation growth has surpassed the peak of 2008, which, at that time, was a consequence of economic overheating. Terms such as "fiscal consolidation" and "anti-inflation plan" are still etched on many people's memories. Yet, the current situation differs substantially: there are other drivers of inflation and hence also other solutions in place. If inflation takes root and triggers a price-wage spiral pushing inflation even higher, the government will have to apply measures that reduce demand and slow down economic growth. To avoid this, a well-considered and prudent fiscal policy that, to the extent possible, provides support and a security reserve is still a principle worth observing.

Chart 1. Inflation or changes in consumer prices in Latvia (year-on-year, %)

Causes of the elevated inflation

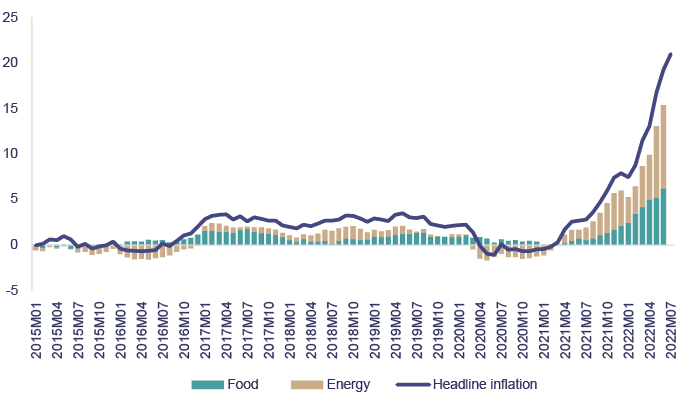

In March of this year, I discussed the causes of the inflation surge in detail, see the respective article here (in Latvian only). The initial push was given by the economic recovery from the Covid-19 crisis and the associated factors, including a drop in prices at the onset of the pandemic, a shift in consumption from services to goods and supply chain disruptions. Support programmes made it possible to avoid high unemployment, build up savings and help the consumption to recover swiftly. Events occurring in the European Power Market in relation to the low rainfall and weak wind energy production, as well as the decrease in the nuclear power capacity played a major role. Russia's attack on Ukraine on 24 February 2022 drastically worsened the situation and pushed inflation to new highs. Global energy and food prices skyrocketed, bringing more and more new supply side shocks on top of the previous ones.

Consequently, it can be said that the current price increase in Latvia is largely caused by global developments. This marks a considerable difference from 2007 and 2008, when the elevated inflation in Latvia was mainly a result of our own actions. This time, we should realise that it is not within our power to fundamentally change global events; thus, our task is slightly different: to make the "pain" caused by inflation more tolerable and shorter in duration, as well as to avoid the previous mistakes, namely, to prevent inflation from taking root and creating a price-wage spiral.

Chart 2. Inflation in Latvia and its components (%, percentage points)

Given the global nature of the inflation drivers, the situation is rather similar in other euro area countries as well. For instance, in 2008, when Latvia's inflation rate was similar to the current one, the inflation rate in Germany fluctuated around 2%–3%. At present, Germany's inflation has exceeded 8%, which is unprecedented since World War II. Prices are also spiking in the European countries which have not adopted the euro. High inflation is currently a global problem.

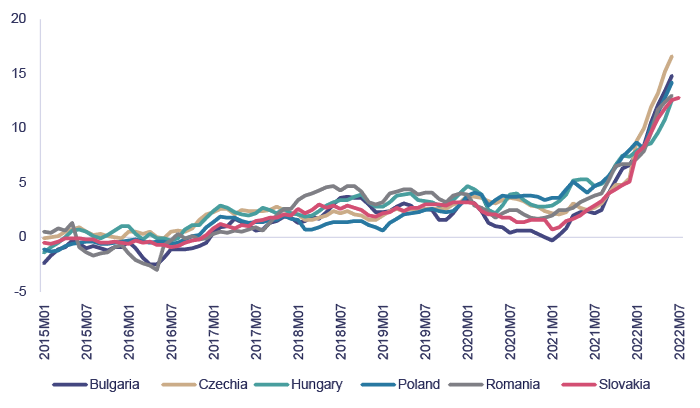

Chart 3. Inflation in Eastern European countries (year-on-year, %)

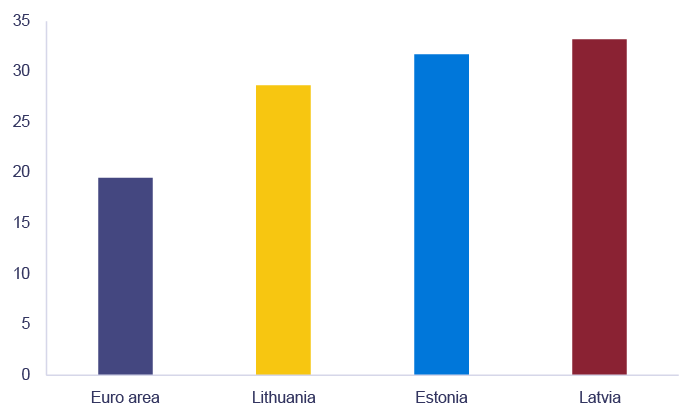

Nevertheless, Latvia's inflation rate is one of the highest in the euro area (only Lithuania and Estonia have experienced a broadly similar or steeper price increase). What are the reasons behind this?

Firstly, the answer lies in the consumption structure. The people of Latvia spend most of their everyday budget on food and energy, the very same product categories that witness the largest price hikes in global markets. Namely, in Latvia, approximately 40% of the population's money is spent on food and energy, while in the euro area the respective share is, on average, 26%. Although changes in the prices of these products are determined by global market developments, which are similar in various countries, the rise in food and energy prices has a greater effect on the purchasing power of Latvia's population and inflation rate.

Secondly, this year's food and energy prices in Latvia and other Baltic States have grown faster than elsewhere in Europe. It might be due to a number of reasons. For instance, the structure of contracts and the regulatory framework: the more frequently the administered prices are revised, the sooner the upward trend in energy prices is incorporated in the final price. Also, the share of commodities in productions costs: the larger the share, the more the price increase is reflected in the final price. Price hikes may be affected by government support measures: whether the energy price rise is partially offset by benefits, whether an energy price cap is set, whether the hikes are reduced by the regulative framework and compensations to energy companies and whether the respective taxes are temporarily cut. In the context of fixed-term tax cuts it should be added that a) it is usually an expensive (in budgetary terms) and poorly targeted measure, and only part of the tax reduction actually reaches the consumer; b) after the tax cuts expire, prices climb again, thus causing future inflation and a risk of prolonging the inflation problem.

Chart 4. Energy and unprocessed food price hikes in June 2022 (since the beginning of the year, %)

Thirdly, evidence suggests that companies in Latvia are much more ready to change prices than companies in other euro area Member States. A recent study (available here) by my colleagues found that price volatility in Latvia is about a half higher than the euro area average. This gives reason to believe that companies can transfer commodity price changes to final product prices much faster; currently it translates to a price increase that occurs at a more rapid pace than elsewhere. One of the possible reasons is weaker competition.

Fourthly, the transfer of energy and commodity price hikes to the prices of other products may depend on the strength of the demand and the tightness of the labour market. A robust labour market sees a wage rise, and it is easier to increase prices, since consumers can "afford" the price increase. It should be noted that the labour market temperature observed in Latvia and other Baltic States exceeds the average temperature in the euro area.

How to protect society from such sharp decline in its purchasing power? In light of the above information on the factors constituting inflation, the response should also be manifold. The inflation problem will be partly solved when the situation in global energy and food markets normalises, alternative energy resources are found and Russia's influence is diminished. However, there are also things we can do ourselves to dampen the negative effect of the elevated inflation.

What should the central bank do?

The euro has been Latvia's currency since 2014, and the decisions on the monetary policy are made, taking into account the common needs and interests of the euro area. Of course, no central bank can reduce the global oil or grain prices or stop the war in Ukraine. However, there are monetary policy measures that can ensure this initial price hike caused by external factors does not take root, does not turn into an increase in prices of other goods and services or a price-wage spiral when price hikes drive up wages, wages drive up prices, thus worsening the situation and prolonging the "pain" inflicted by inflation. Thus, the Governing Council of the European Central Bank (ECB) announced already in December 2021 the gradual ending of economic support or asset purchase programmes and an imminent rise in interest rates.

On 21 July of this year, for the first time in more than 11 years, the Governing Council of the ECB decided to raise interest rates. Key rates were raised by 0.5 percentage points. The age of the negative rates is over. To bring inflation back to its 2% medium-term target in the euro area as a whole, the rates will be also increased further. Already in June, we witnessed the end of the last asset purchase programmes, which were introduced in the previous years as support for the euro area economy that experienced a long battle with overly low inflation.

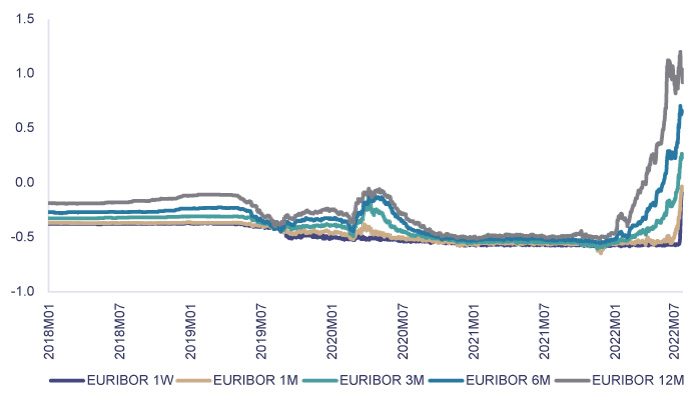

Chart 5. Euro money market rates with different maturities (%)

Financial markets react proactively, based on expectations of the monetary policy changes, and the financial market interest rates grew in the first half of the year, already before they were raised by the Governing Council of the ECB. This is reflected in higher interest rates on loans in the economy. For instance, the widely used 3-month EURIBOR stood at –0.5% in late 2021, became positive already in early July and reached 0.23% at the moment of writing this article. This means that floating rate loans will see an increase in the monthly instalments after the next recalculation. Awaiting further rate increase by the Governing Council of the ECB, financial market participants price in the rate increase in the future. For instance, 3-month EURIBOR for late 2024 is priced in already above 1.3%. Alongside the interest rates on loans for the population and businesses, the government debt servicing costs take an upward trend, thus limiting resources the state can dedicate to covering various needs. Eventually, it is all reflected in a lower economic activity and lower pressure on prices.

It is fair to question whether an increase in loan payments is a prudent decision at the time when people's wallets are already hit hard by the elevated food prices and higher energy tariffs. The response: unfortunately, a rise in interest rates is the "medicine" that is necessary so that a one-off price increase does not turn into an uncontrollable price-wage rise spiral that is difficult to stop. Clearly, the side effects caused by medicine can be unpleasant. Although energy and food remain the key drivers of inflation, price hikes have expanded significantly. Prices are rising for a wide range of goods and services; this contributes to the risk of inflation taking root. When deciding on the future steps with the colleagues from the Governing Council of the ECB, we will act prudently, decisively and flexibly and develop monetary policy conditions relevant to the economy of the euro area, thus also Latvia. Our objective is to ensure the elevated inflation does not take root and the "pain" caused by it is as short-lived as possible.

What to do in Latvia?

The current situation calls for the retention of flexibility in other policy areas as well, primarily in fiscal and energy policy. Global economic growth has moderated, inflation is higher than projected, and the risks of recession have risen. Even though there is, indeed, no reason for forecasting a deep economic crisis in Latvia at present, economic growth has already been decelerating and the risk of a moderate recession towards the end of the year is high. Therefore, a radical fiscal consolidation would not be the right choice at this moment. This time, support is needed for the societal groups that are hit hardest by inflation. Such approach is reflected in the government's decision of 22 June 2022; concrete legal acts approved by the Cabinet of Ministers are still necessary.

Heating and electricity bills will increase several times. Latvijas Banka's estimates suggest that, owing to energy price hikes, household spending during the second half of the year will see an increase by almost 300 million euro if compared with the pre-Covid-19 situation. Heating is not an area where it is possible to reduce consumption swiftly; thus it is clear that it will be difficult without support, not only for the less wealthy population, but also for the middle class. Therefore, the government's intention to limit an extremely rapid rise in heating costs should be supported. A rapid growth in prices comprises a wide range of goods and services; consequently, an expansion of benefits for the less wealthy population with the aim of cushioning the blow caused by inflation is also the right course of action. The government support should be timely, targeted, proportionate and limited in time. It should be timely so that the population would not reduce consumption too excessively and would not drive the economy into a deeper recession. It should be targeted to help those who need it most; by providing support to everyone in an untargeted manner, those most in need are actually given less. It should be proportionate to avoid an even larger inflation surge. It should be limited in time to encourage changes in habits and adaptation to a permanent change in the economy (for example, high energy prices) and to retain fiscal discipline in the government budget.

Support provided to the population is also support provided to businesses. Additionally, it is important to consider whether the competitiveness of Latvia's businesses is not critically impaired owing to energy prices, with the state retaining the possibility to use the measures at its disposal in a targeted manner.

It is clear that elevated energy prices are here to stay in the foreseeable future. This winter, it is essential to ensure the availability of gas as its lack will drive the price up even further. However, the issue is not only about this winter. Thus, a total isolation of the population and businesses from price hikes is not a forward-looking approach. The government budget will never have enough money for a complete and permanent subsidy on rising prices; furthermore, such subsidy would act as an anchor pulling the economic development down, as it will not encourage energy efficiency improvements, the diversification of types of energy and energy supply sources and a larger share of renewables. Such action will not reduce vulnerability to energy price and supply shocks or inflation caused by these shocks. The Green Deal is not an abstract phenomenon, it involves concrete measures for energy efficiency, energy independence and sustainability. A clearly communicated government outlook on the key changes in energy policy would allow a well-considered adaptation to these changes without an excessive price pressure in construction and other related sectors.

Conclusion

The peak of inflation is possibly on the horizon. The economy cannot bear such elevated inflation for a long time: with demand decelerating, pressure for prices to rise will diminish. However, even though prices stop climbing, inflation can remain unacceptably high. There is currently no need for an anti-inflation plan that was in place in 2007 and 2008. Yet, a number of measures should be implemented to ensure that the inflation race ends sooner and is less "painful".

- The Governing Council of the ECB should continue raising interest rates so that the elevated inflation does not take root and recedes swiftly when global energy and food prices normalise.

- Support that is timely, targeted, proportionate and limited in time should be provided by the government to the population to diminish the "pain" inflicted by inflation.

- The availability of gas, energy efficiency improvements, the diversification of types of energy and energy supply sources and a larger share of renewables should be ensured. A clearly communicated government outlook on the key changes in energy policy will allow a well-considered implementation of these changes without an excessive price pressure in construction and other related sectors.

- A competitiveness that would force efficiency improvements and reduce possibilities to transfer the commodity price increase to final product prices should be strengthened.

And we continue helping Ukrainians. It is important for Ukraine to win this war and for Russia's imperial ambitions to be shattered. It is also essential because otherwise we will be sitting on a powder keg of inflation for years to come.

Textual error

«… …»