Will the lending increase persist?

Albeit in September positive trends were observed in lending and loans granted both to businesses and households continued to grow, the future looks less certain. Despite the decisive measures taken by the Eurosystem, lending in Latvia at the beginning of next year will be impeded by the caution dictated by the external risks and the disorganized legal environment.

The month of September brought a positive message in lending: the total bank domestic credit portfolio grew for a second consecutive month. The growth was not fast – the portfolio increased by 14 mil. euro or 0.1% - both the loans granted to businesses and those granted to households went up at this rate. More rapidly, by 4.3%, grew only the loans extended to financial intermediation businesses.

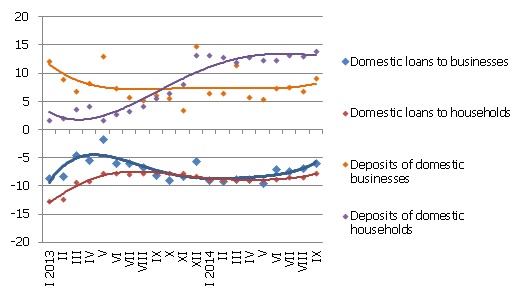

Even though on account of dropping business deposits the total balance of domestic deposits attracted by banks has dropped slightly, both the annual growth rate of deposits and the amount of household deposits have increased.

The total balance of deposits by both businesses and households dropped in September by 0.4%, yet the annual rate of growth of domestic deposits increased to 10.8%. Household deposits rose 1.4% month-on-month (the annual growth rate in September was at 14.0%), whereas the business deposits dropped by 2.6% (annual growth rate at 7.1%).

As for the changes of Latvia's contribution in the common money indicator for the euro area M3, the overnight deposits of euro area residents with Latvian credit institutions dropped by 0.3% in September, deposits redeemable at notice grew by 2.0% and deposits with a set maturity of up to 2 years – by 1.4%. The total Latvian contribution to the euro area money supply was slightly reductive, as the amount of cash currency in circulation shrank.

As the bank total domestic loan portfolio grew in September, the annual drop rate of loans improved to 5.6%. A substantial increase in loans granted to financial intermediary businesses continued: their annual rate of growth in September reached 33.5%. Within the framework of lending to households, only the balance of housing loans dropped, whereas consumer lending grew for a third consecutive month. The indicator of the rate of annual decrease in loans for those granted to businesses was 3.6% in September and that in loans granted to households was 7.8%.

Illustration. The year-on-year change in some money indicators (%)

Source: Latvijas Banka

With the risks in the external markets persisting and export income shrinking, we cannot expect a substantial rise in business deposits, whereas the desire of households to form security deposits with banks will probably increase both private person deposits and the total amount of deposits. Albeit the lending indicators in the last several months have been even better than expected and the situation could further improve by the end of the year, next year, the improvement in lending will proceed at a slower rate. Parallel to caution stimulated by external risks, a slowing influence can be expected from the impact of amendments to the Insolvency Law on mortgage lending as well as from the legal environment problems in the area of insolvency (See Commercial banks express solidarity with Norvik Banka in combating corruption in Latvia), and that will not be fully compensated by the monetary policy decisions of the Eurosystem directed at promoting lending.

Textual error

«… …»