Weathering the storm

Overall, the domestic loan portfolio has remained broadly unchanged, with loans to non-financial corporations posting a minor increase of 0.1%, but household loans contracting by 0.2%. As to bank deposits, those received from non-financial corporations shrank moderately, while those deposited by the household sector moved up slightly.

In February, the annual rate of decrease of the domestic loan portfolio remained at 2.8%, inter alia with the change ratios in the loan portfolios of non-financial corporations and households in annual terms also seeing the same levels as before, i.e. -8.5% and -1.1% respectively. The amount of new loans, however, reflected a certain moderation in market developments, lagging behind the levels of both January 2018 and February 2017.

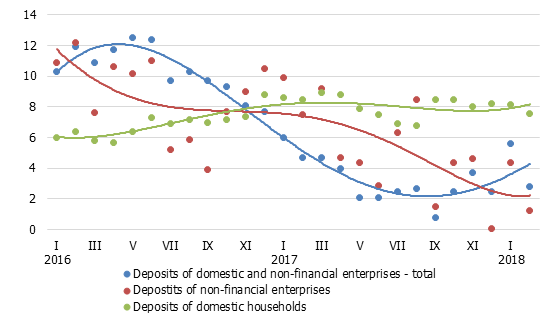

In February, domestic bank deposits decreased by 1.2%, with deposits of non-financial corporations declining by 1.1% and household deposits edging up by 0.1%; consequently, the annual rate of their growth stood at 2.8%, 1.3% and 7.6% respectively.

In February, the annual rate of change in Latvia's contribution to monetary aggregate M3 of the euro area was 6.2%, including 7.9% in the case of overnight deposits of euro area residents placed with Latvia's MFIs, 6.9% for deposits redeemable at notice, and -6.7% for deposits with an agreed maturity of up to two years.

Annual changes in domestic deposits (%)

The turbulences having affected some financial market participants have not had a substantial impact on the domestic loan portfolio and the received deposits, although the structural changes associated with the self-liquidation of the ABLV Bank can still be expected to influence monetary aggregates. Nevertheless, even if projects launched by the above bank might be temporarily delayed, the funding currently available in the banking sector allows us to hope that the potentially profitable projects will be implemented, while the domestic deposits are gradually shifted to other credit institutions in Latvia.

Textual error

«… …»