Trends in monetary aggregates remain unchanged

The overall development trends in bank loans and deposits remained unchanged in September despite a minor increase in the domestic loan portfolio and contraction of deposits.

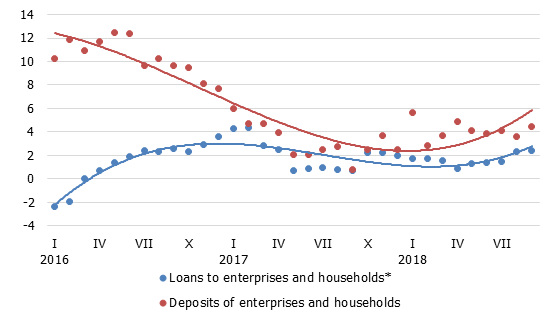

The annual rate of decline in the domestic loan portfolio was –3.3% in September, significantly less negative than a month earlier. This can be explained by the fading base effect caused by the partial transfer of Nordea Bank AB loan portfolio to its parent bank outside Latvia (without the effect of the cancellation of the ABLV Bank licence, the annual growth of the domestic loan portfolio was 2.4%). The annual rate of change in the loan portfolio of non-financial corporations amounted to –4.8% (or 1.2%, excluding the above effects), whereas the annual rate of change in the household loan portfolio stood at –6.2% (or –0.7% respectively).

Domestic bank deposits declined by 1.0% in September, with deposits by non-financial corporations shrinking by 1.8% and household deposits growing by 0.4%. Latvia's contribution to the monetary aggregate M3 of the euro area decreased by 1.1% in September, with overnight deposits of euro area residents with Latvia's monetary financial institutions and deposits with an agreed maturity of up to two years contracting by 1.0% and 3.9% respectively, whereas deposits redeemable at notice growing by 0.5%.

Annual changes in domestic loans and deposits* (%)

* For the sake of comparability, the one-off effects related to the restructuring of Latvia's banking sector have been excluded.

Positive growth of deposits, almost at the overall rate of economic growth, points to the stability of business and consumer confidence as well as reliance on the banking sector despite this year's turbulences.

Although lending development also remains solid, with the adjusted annual growth remaining at the level of 1%–2% for the second consecutive year, the economy could really benefit from more sizeable loan injections. Despite the emergence of some new incentives with a potential to boost lending, like giving Latvian businesses access to guarantees from the European Bank for Reconstruction and Development to obtain bank financing, the regular lending survey of Latvia's major commercial banks so far contains no clear signals of a convincing recovery. Only individual banks report a slightly higher loan demand in the third quarter, and further improvement in the fourth quarter is expected neither in corporate lending, nor in household lending. Therefore, no major changes in this respect can be anticipated in the near term.

Textual error

«… …»