Structural changes leave the trends of monetary aggregates unaltered

In July, the decline in domestic loans can be explained by a one-off factor – the decision of the European Central Bank to cancel the licence of JSC ABLV Bank on 11 July. However, excluding the impact of JSC ABLV Bank, lending trends remained broadly unchanged in July, with the loan portfolio of non-financial corporations rising somewhat and that of households posting just a minor increase. At the same time, the cancellation of the bank's licence had almost no impact on the volume of domestic deposits, and the amount of deposits fluctuated within the usual range: corporate deposits contracted slightly, while household deposits continued to increase.

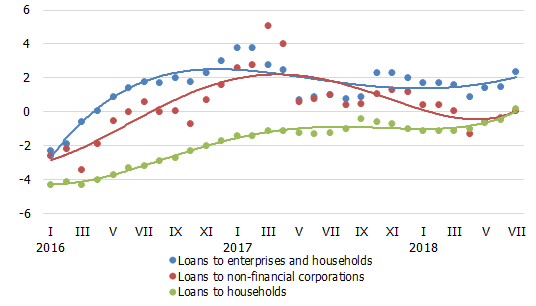

In July, the annual rate of decrease in the domestic loan portfolio reached –8.2% (excluding the transfer of part of the loan portfolio of Nordea Bank Finland Plc to its parent bank outside Latvia and the effects of the cancellation of the licence of JSC ABLV Bank, the domestic loan portfolio grew by 2.4% year-on-year). The annual decrease ratio of the loan portfolio of non-financial corporations amounted to –15.0% (excluding the above effects, the annual growth rate of the loan portfolio is +0.1%), while the annual rate of change in the household loan portfolio stood at –5.8% (+0.2% respectively). In July, the amount of new loans granted to non-financial corporations was smaller, while that of loans to households was slightly higher compared with the corresponding month of the previous year.

In July, domestic bank deposits declined by 0.4%, with corporate deposits shrinking by 1.1%, but household deposits growing by 0.2%. Latvia's contribution to the monetary aggregate M3 of the euro area expanded by 6.3% in July, with its annual growth rate standing at 12.9%. Within a month, both overnight deposits of euro area residents with Latvia's monetary financial institutions and deposits with an agreed maturity of up to 2 years increased significantly by 7.5% and 4.3% respectively, while deposits redeemable at notice decreased by 1.1%.

The annual rate of change in domestic loans (%)

* To ensure comparability, the one-off effect is excluded as of September 2017 due to the transfer of part of the loan portfolio of Nordea Bank Finland Plc to its parent bank and as of July 2018 – on account of the cancellation of the licence of JSC ABLV Bank.

The improvement in consumer and industrial sentiments promises a gradual rise in demand for loans. As to businesses, it will be also supported by the necessity to boost capacity and production efficiency under increasingly pressing labour availability conditions, whereas households will be encouraged to borrow by rising employment and income and the considerable support for house purchase provided by JSC "Attīstības finanšu institūcija Altum", including the intention to extend it to families with a large number of children.

Textual error

«… …»