Stability with a positive note

In August, a slow growth in the overall domestic loan portfolio was observed for a sixth consecutive month and the loan 12-month growth rate also remained in positive territory. With the funds in enterprise bank accounts on the rise, the balance of deposits attracted by banks also grew.

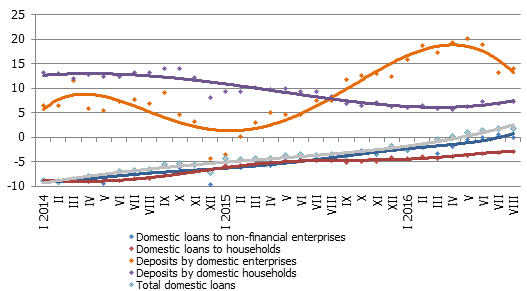

The balance of the domestic loans of banks in August increased by 0.2%, with the loans granted to nonfinancial enterprises increasing by 0.3%, loans to financial institutions by 1.3% and consumer loans to households by 1.1%. The housing loan balance continued to contract gradually and slowly (by 0.2%). The rate of 12-month increase in total domestic loans in August was at 1.7%, including 0.0% in loans to nonfinancial companies and 58.7% to nonbank financial institutions. The 12-month rate of decrease in loans granted to households dropped to 2.9%.

Domestic deposits attracted by banks increased in August by 0.9%, with their 12-month rate of growth reaching 10.3%. Deposits by enterprises increased by 2.3% (annual growth rate of 14.0%), whereas deposits by households dropped by 0.3% (annual growth rate of 7.2%).

With deposits increasing, so did Latvia's contribution to the euro area total money supply indicator M3. Overnight deposits of the euro area residents with Latvian credit institutions in August increase by 1.0% and deposits redeemable at notice by 0.8%, with only deposits with the set maturity of up to two years dropping minimally. Altogether, Latvia's contribution to the euro area M3 increased by 0.9%, which amounted to 10.3% growth year-on-year.

Y-y changes in some money indicators (%)

Source: Latvijas Banka

With each passing month in which a rise, albeit small, yet stable, the conviction is reinforced that the stagnation period in lending is coming to an end. Even though the mood of loan takers has not substantially improved as a result of the external situation and cautious economic growth projections, banks' assessment regarding further growth (e.g., that of SEB bank) gives rise to a positive view of the future. This is fostered by the conclusions by the Association of Commercial Banks regarding lending growth and suggestions on how to foster lending. Growth in lending could be stimulated also the results of the September auction of the second stage of the European Central Bank's targeted longer-term refinancing operations along with the impact of other monetary policy measures taken by the system of the European Central Banks.

Textual error

«… …»