Spending and borrowing resumes

With the fight against the Covid-19 pandemic entering the phase of active vaccination and the spread of the virus abating, restrictions are being gradually lifted in different areas of life. This is most apparent from the rapid rise in the retail turnover following the easing of restrictions on retail stores. The opportunities to provide and receive services also expanded notably. Moreover, tourism and cultural events will gradually become more accessible. These developments have led to an improvement in the economic sentiment of households and businesses, thus boosting higher spending and the appetite for borrowing.

Even though households have continued increasing their bank account savings, their growth has moderated over the past few months.

Meanwhile, businesses have organised their cash flows, so that they do not build up savings but rather use their revenue for imports and investment. The household loan portfolio is recording robust growth: housing loans are on a moderate rise, and consumer lending is also gradually recovering. The portfolio of corporate loans has been more volatile. Nevertheless, the growing volume of new loans suggests positive dynamics also in this sector.

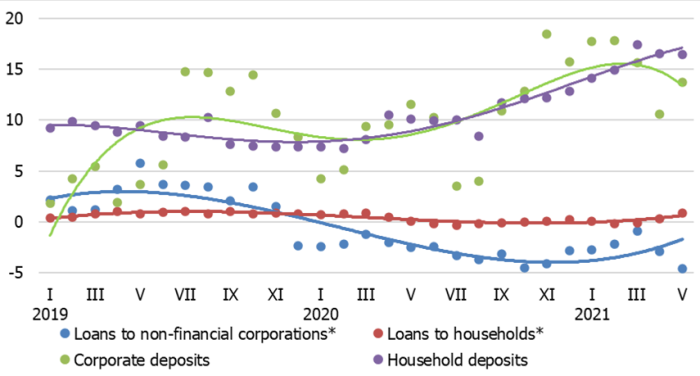

Even though spending possibilities increased, growth in household deposits seen in March and April as well as demand for cash was facilitated by the one-off benefit of 500 euro per child as well as the one-off benefit of 200 euro as a state support to Latvian citizens receiving Latvia's pension or the state social security benefit. Meanwhile, in May the growth rate of household deposits was the lowest seen over the last 10 months. Following a more rapid rise in March, corporate deposits declined in April and rebounded in May. The annual growth rate of deposits reached a 14-year high in March (16.7%), before declining slightly to 15.4% in May (including a 13.8% and 16.5% rise for corporate deposits and household deposits respectively). In March-May, deposits overall increased by 3.0% (as compared to a 4.3% rise recorded in the previous three months), inter alia household deposits rose by 5.2% (previously – by 5.6%). In the past three months, corporate deposits declined by 0.1% as compared to a 2.4% growth posted in December-February.

Owing to more positive economic development and sentiment trends as well as the accommodative monetary policy, in March-May the domestic loan portfolio grew by 0.6%, with loans to non-financial corporations declining by a mere 0.2% and loans to households increasing by 0.8% (inter alia, housing loans grew by 1.1%). Following a prolonged period of stagnation in the first quarter of 2021, the domestic loan-to-GDP ratio increased by 3 percentage points to stand at 41%, thus giving rise to hopes for more significant loan injections to foster economic growth. In May, the annual rate of change in domestic loans reached 4.8%. Nevertheless, excluding the impact of the restructuring of the banking sector and the reclassification of institutional sectors, as well as that of one-off factors, the annual rate of change of the loan portfolio remained in the negative territory for loans overall (–1.4%) and for loans to non-financial corporations (–4.6%), while the annual rate of change for loans to households already climbed to 0.9%. An expansion in new loans – both new loans overall and those granted to businesses and households in particular – suggested a positive trend in lending. In the last three months (March-May), new loans recorded a 66% increase over the previous three months, with new loans to households and those to non-financial corporations recording 46% and 87% growth respectively. The year-on-year rise of new loans was even steeper.

Against the background of further success in the fight against Covid-19, higher foreign and domestic demand and improved economic sentiment indicators, lending is expected to follow a positive and gradual upward trend. With the economy reopening further and the spending opportunities increasing, deposit growth will moderate.

Chart. Annual changes in domestic loans and deposits (%)

*For the sake of comparability, the one-off effects related to the restructuring of Latvia's banking sector and the reclassification of the institutional sectors have been excluded.

Textual error

«… …»