Situation improving in lending

Even though no radical changes in the money indicators were observed in October, almost all lending-related indicators improved slightly: either the loan portfolio increased in absolute numbers or at least the annual drop rate decreased. The total balance of deposits increased slightly – primarily in the household sector. Since the rise in deposits was slight and the demand for cash currency diminished, Latvia's contribution to the total euro area money supply M3 remained practically unchanged.

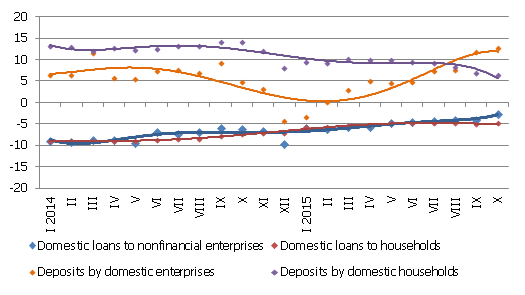

In October the domestic loan portfolio of banks increased by 0.1%, including a rise of 0.4%, in loans to nonfinancial enterprises, whereas loans to households dropped by 0.2% (including a 1.6% rise in consumer loans). The annual drop rate for domestic loans in October was -3.2% (the smallest drop since mid-2009), incl. -2.7% for loans to nonfinancial enterprises and -4.9% for loans to households.

The total balance of bank-attracted domestic deposits in October increased by 0.4%, and their annual rate of growth reached 9.1%. Household deposits rose slightly faster (by 0.6%), whereas enterprise deposits remained almost unchanged.

The changes in Latvia's contribution to the total euro area money indicator M3 were slight. The overnight deposits by euro area residents with Latvian credit institutions dropped by 0.4% in October, whereas deposits with a set maturity of up to two years increased by 3.6% and deposits redeemable at notice by 0.7%. Altogether, Latvia's contribution to euro area M3 increased by 0.1% and, year-on-year, by 9.2%.

Y-y changes in some money indicators (%)

Source: Latvijas Banka

The positive developments in lending that have been expected for some time are gradually becoming more concrete. Recovery has begun in lending to businesses, with not only the amounts of newly granted loans increasing, but also, in the first ten months of 2015, the total loan portfolio – albeit slightly. Moreover, there is no reason to expect this trend to change. In the household sector, consumer lending has increased this year, whereas the contraction rate in housing loans has slowed and banks are of the opinion that the environment for housing loans is currently favourable in Latvia and the amounts of mortgage loans are expected to grow next year. Lending to households will also be fostered by the predicted low interest rates and rise in resident incomes. The lending potential is supported also by the rise in business and household accruals, which is gradually increasing their creditworthiness.

Textual error

«… …»