A seasonal drop in deposits was observed in January

In January, we were witnesses to the annual trend of a change in money indicators when, after a seasonal rise in December, the deposits attracted by banks, the demand for cash and thus also the total money supply contracted. Economic stability, however, resulted in a smaller seasonal drop in deposits than in the relevant period last year and the annual rate of growth in deposits continued to rise. The domestic loan portfolio contracted at a slower rate than in the previous month.

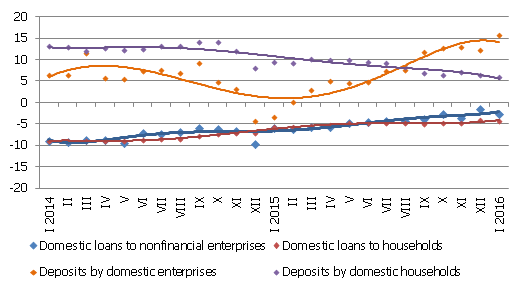

The total balance of bank attracted domestic deposits in January dropped by 1.0%, whereas their annual rate of growth rose by 1.3 percentage points, to 10.3%. The deposits of enterprises dropped moderately and those of households did so only slightly. The annual rate of growth in enterprise deposits increased to 15.8% and that of household deposits dropped to 6.0%.

Along with the drop in deposits, the Latvian contribution to the euro area common money indicator M3 also decreased. The overnight deposits of euro area residents with Latvian credit institutions in January dropped by 1.2% and deposits with the set maturity of up to two years by 3.3%, with only the deposits redeemable at notice continuing to grow (by 2.9%). Overall, the Latvian contribution to the euro area M3 dropped by 1.2%, exceeding the level of the corresponding period of the previous year by 9.7%.

In January, bank domestic loan portfolio dropped by 0.6%, including loans to non-financial enterprises by 0.7% and loans to households by 0.3%. The annual rate of reduction in total domestic loans was -2.3%, including loans to nonfinancial enterprises at -2.6% and loans to households at -4.3%.

The annual rate of change in some money indicators (%)

Source: Latvijas Banka

The slight drop in monetary indicators in January does not change the overall optimistic outlook on growth expected in 2016. The increasing annual rate of growth of deposits is evidence of the seasonal character of the drop in deposits, leading to expectations of renewed increase of deposits in absolute terms over the next few months. In lending, the expected positive changes on the side of both supply and demand are borne out both by the evaluation by banks themselves and by the Association of Latvian Commercial Banks and by predictions by the Financial and Capital Market Commission.

Textual error

«… …»