The rise in lending is stabilizing

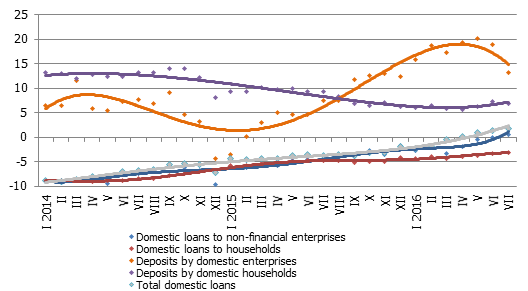

In July, for a fifth consecutive month, a rise in the total domestic loan portfolio was registered and, for a fourth consecutive month, the loans granted to non-financial enterprises grew. Even though in the absolute sense the rise was moderate, the annual rise in loans stabilized in the positive sector. On the other hand, the balance of deposits attracted by banks shrank in July, as the funds in the current accounts of non-financial enterprises dropped.

Banks' domestic loan balance in July increased by 0.2%, with the loans granted to non-financial enterprises increasing by 0.4%, loans to financial institutions by 0.5% and consumer loans to households by 1.0%. Only the housing loan portfolio continued to contract slowly. The rate of the annual rise in domestic loans reached 1.8% and the rate of loans granted to non-financial corporations by 0.6%. The rate of the annual decrease in loans granted to households dropped to 3.1%.

The domestic deposits in banks decreased in July by 1.0%, with the rate of their annual increase amounting to 9.7%. Household deposits increased by 0.2% (annual growth rate was 6.9%), but the deposits of enterprises dropped by 2.5% (annual rise of 13.1%).

The drop in deposits decreased Latvia's contribution to the euro area total money indicator M3. The overnight deposits by euro area residents with Latvian credit institutions dropped by 1.0% in July and this drop could not be compensated either by the 0.6% increase in deposits redeemable at notice or the 1.2% increase in the deposits with a set maturity of up to two years. In total, Latvia's contribution to the euro area M3 shrank by 0.6%, growing year-on-year by 9.7%.

The annual changes in some money indicators (%)

Source: Latvijas Banka

After the long period of shrinking, lending in Latvia has reached a new stage: the total loan portfolio and that of loans granted to enterprises has begun to grow slowly and even in lending to households positive trends are observed: the growth in consumer lending has resumed and the contraction in house lending is slowing down. Even though we are not expecting particular increase in lending in the near future, the stability in the situation and the slow recovery is most likely going to continue. With the access to the European Union structural funds increasing, the house support programme continuing and demand for consumer loans increasing, the portfolio of loans granted by banks will also grow. At the euro area level, the growth in lending will continue to be favourably impacted also by the previously adopted decisions on accommodative monetary policy

Textual error

«… …»