Rapid growth continues in manufacturing; global trends point to slower development in future

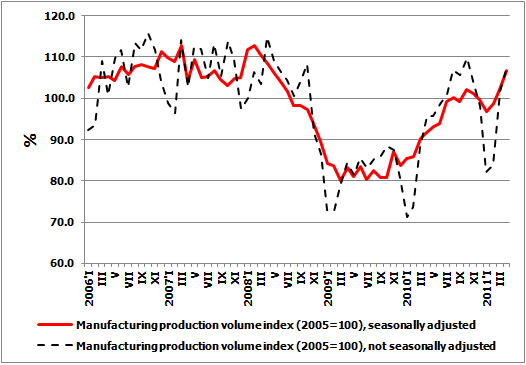

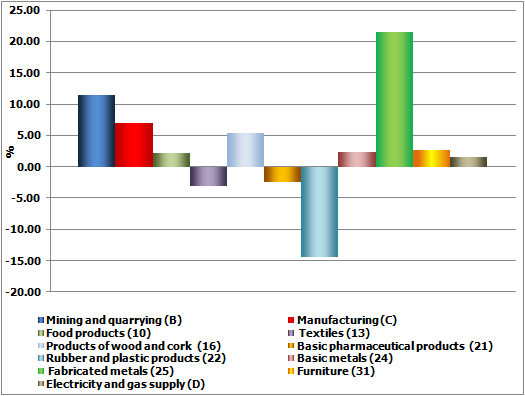

After a notable growth in the previous month, manufacturing output in April also grew substantially, which seems a bit surprising. Manufacturing output in April grew 4.4% month-on-month according to seasonally adjusted data, whereas according to calendar-adjusted data, a 17.0% year-on-year increase was observed. Thus in the first four months of the year, manufacturing output according to calendar-adjusted data has grown 14.1% year-on-year. According to seasonally adjusted data, the manufacturing output level in April approximated the level at the beginning of 2008. The rapid growth in April was primarily ensured by the production of ready-made metal products, chemicals, and textile products.

Although manufacturing output this year has grown substantially, the dynamics of manufacturing could slow in the coming months. The industry confidence indicator (compiled by the European Commission) dropped 0.2 points in April and 0.8 points in May. According to the data of confidence surveys, the outlook of manufacturers regarding the amount of potential export orders has deteriorated substantially in the last two months. It should also be noted that industrial confidence is substantially deteriorating also in the EU and euro area, which may be a reaction to the rise in the raw material prices and doubts regarding the stability of future demand. The evaluation of manufacturer stock level is therefore gradually on the rise while still being very low from the historical perspective.

The manufacturer concerns about the drop in order volumes are also confirmed by the statistics of new orders. Confidence surveys are based on intuitive evaluations of the future by manufacturers (contracts, agreements) while the statistics of new orders are based on orders already made or agreed upon. Although the annual rate of growth remains very high (+34.1% in March), seasonally adjusted month by month data point to a drop. In March of this year, the amount of new orders dropped 6.4% month-on-month (seasonally adjusted data), incl. exports by 8.4%. In breakdown by industry, monthly growth was retained in the production of clothing, chemicals, pharmaceuticals, metals, and automobiles and trailers. According to the new order statistics, the recently stagnating production of chemicals may gradually begin to recover in the coming months.

Already for two consecutive months (data up to and including March of this year) the turnover index of manufacturing is dropping in exports while increasing domestically. Also year-on-year, the turnover increase is slowing down more rapidly in the export markets while slowly accelerating in the domestic ones. An example here is the substantially increased domestic turnover in the production of food products, clothing, electrical devices, timber and furniture. The increases in food products and clothing turnover are captured also in retail data which, to be sure, have yet to point to a stable household consumption recovery: it should be noted that it is in the production of food and clothing that the drop was previously the most substantial. The increase in the local sales turnover of timber points to a possible gradual resumption of construction in the building sector (in engineering, timber is used less).

In the coming months, an equally rapid growth in industrial output volumes is probably not to be expected. Various pre-emptive indicators point to growing pessimism among manufacturers not only in Latvia but also in the euro area and world at large. Thus, for instance, the Purchasing Managers Index (PMI) in the euro area in May dropped by 3.4 points, with Spanish and Greek indicators particularly on decline. The index represents the manufacturers' view of new orders in combination with output amounts, employment, time of deliveries and inventory amounts. Currently it can be predicted that the global manufacturing amounts will contract in the coming months, which is certain to impact Latvian manufacturers, especially those who supply raw materials to subsequent processing stages abroad.

Fig. 1 Manufacturing dynamics

Fig. 2 Growth rates of manufacturing industries as of the beginning of the year (seasonally adjusted data, in % against December 2010)

Textual error

«… …»