Pronounced reduction in demand for cash currency

The total money supply dropped in July. That was primarily the result of the drop in lats cash currency in circulation, unusual for this summer month. The balance of business deposits also dropped slightly. The accruals of households with banks, on the other hand, grew for a sixth consecutive month. The total domestic loan portfolio of credit institutions dropped slightly as a result of repayment housing loans and writing-off of bad loans. The balance of loans granted to non-financial enterprises remained practically unchanged.

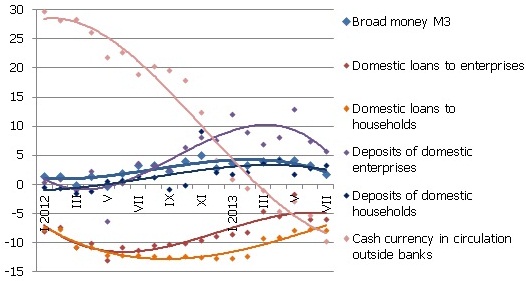

The money indicator M3, which characterizes the amount of cash and non-cash currency in the economy, dropped by 0.8% in July, whereas its annual rate of growth was 1.8%. Just like in previous months, the domestic overnight deposits and deposits redeemable at notice increased, but the deposits with the agreed maturity of up to 2 years decreased. In connection with making the final decision regarding Latvia’s joining the euro area, there was a drop in the demand for cash currency in July – unusually rapid for this month. The amount of cash currency in circulation dropped by 34.3 mil. lats month-on-month and, by the end of July, was 9.7% reduced year-on-year.

Illustration. Annual changes in some money indicators (%)

Source: Bank of Latvia

Domestic household deposits in July increased by 1.1 mil. lats, whereas business deposits dropped by 12.3 mil. lats. The drop in the amount of cash currency promoted a rise in financial means in household current accounts. Households mostly increased their euro deposits, possibly more actively transferring lats cash accruals in euro accounts in banks. The deposits of private businesses increased in the group of other foreign currencies possibly under the impact of the active tourism season.

In July, the total balance of domestic loans dropped by 0.3%, including the balance of loans granted to non-financial enterprises, which remained practically unchanged, and the drop in household loan portfolio by 0.6%. The negligible changes in the total loan portfolio indicated stability in the loan market.

The rate of annual increase in money supply is gradually dropping, reflecting the slower growth in overall economic activity. In the area of lending, pronounced positive trends are yet to be observed, although stability has been noticeable in lending to business activity. The debt level of households is slowly going down. Such a situation will remain the case in the following months as well, but more pronounced changes will continue in the area of demand for cash currency. Compared to the situation in Estonia in the second half of 2010, just before the euro changeover, the demand for lats cash currency has been dropping more rapidly than was the case with the krona in Estonia. This could help to alleviate the possible tensions during the changeover process at the turn of the year.

Textual error

«… …»