The pandemic encourages savings

The second wave of the Covid-19 pandemic and the associated additional restrictions imposed on different areas of life in December have not had a significant impact on the functioning of the banking system. The financial sector has remained stable. Both households and businesses have continued increasing of savings on their bank accounts. Although the bank risk assessment upon expiry of the moratorium on fulfilment of obligations and the cautionary investment decisions constrained lending recovery, no further decline in the loan portfolio was, however, observed.

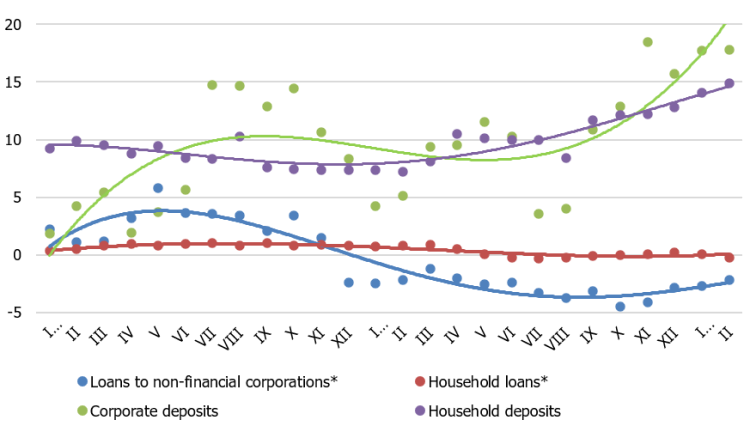

The increased consumption restrictions and deterioration of the business and consumer confidence encouraged involuntary and precautionary savings by constantly accelerating the growth rate of deposits.

In February, the annual growth rate of domestic deposits reached 16.1% or the peak since 2007.

The annual growth rate of corporate deposits reached 17.8%, while that of households was 14.9%.

From December 2020 to February 2021, total deposits rose by 4.3%, including increases of 2.4% and 5.6% in corporate and household deposits respectively. The limited possibilities to spend money according to one’s wishes under circumstances of rising salaries determined a steeper growth in household deposits. Meanwhile, businesses increased their savings by abstaining from new investments, although exports of goods reported a good performance.

The decrease in the domestic loan portfolio is moderate against the background of the pandemic and the negative sentiment: the accommodative monetary policy and the flexible approach of banks towards businesses hit by the crisis accounted for the fact that, as from December 2020 to February 2021, the loan portfolio of non-financial corporations and households shrank by a mere 1.5%, with the corporate portfolio experiencing a somewhat larger decline, while that of households decreasing by only 0.5%.

The crisis and the weaker demand did not affect loans for house purchase which rose by 0.5% during the last three months.

In 2020, the domestic loan-to-GDP ratio remained at the level of the previous year (38%). In January 2021, the total domestic loan portfolio expanded markedly on account of loans to financial institutions determined by a one-off factor, i.e. as a bank acquired a leasing company, the loan to this financial institution was refinanced. Consequently, the annual rate of change of domestic loans returned to a positive territory and reached 3.9% in February. Nevertheless, excluding the impact of the restructuring of the banking sector and the reclassification of institutional sectors, as well as that of one-off factors, the annual rate of change of the loan portfolio remained in the negative territory for loans overall (-1.4%), for loans to non-financial corporations (-2.2%) and for loans to households (-0.2%).

A further decrease in the total amount of new loans and those granted to the household sector suggested that the lending activity was still low. The number of new loans granted during the last three months (December – February) was by 4.9% lower than that of loans granted in the previous three-month period: by 14.3% less for loans granted to households, while non-financial corporations received by 4.2% more.

Given the negative economic sentiment indicators, no noteworthy recovery in lending is likely to be expected in the near future. The government support measures to sectors hit by the

Covid-19 crisis could lead to a reduction in demand for loans, while the one-off payment of 500 euro support to families per child and the one-off 200 euro benefit to retired people could result in an increase of household deposits.

Annual changes in domestic loans and deposits (%)

*For the sake of comparability, the one-off effects related to the restructuring of Latvia's banking sector and the reclassification of the institutional sectors have been excluded.

Textual error

«… …»