Money supply has resumed climbing

Despite the ever more rapid decline in the demand for cash currency, the total money supply increased in Ocbober on account of a substantial rise in the deposits of both businesses and households. The bank loan portfolio, on the other hand, continued to diminish, with the newly granted loans lagging behind the amounts of repaid loans.

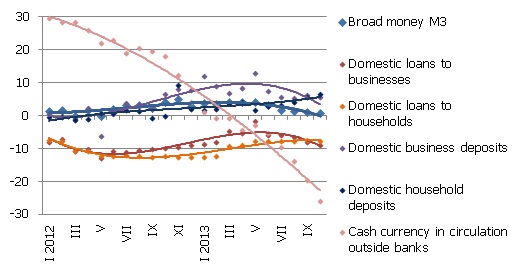

Money indicator M3, which characterizes the amount of cash and non-cash currency in the economy increased by 0.6%, with the rate of its annual growth at 0.8%. With the end of the year approaching, the amount of cash lats in circulation declined at an ever faster rate (by 74.7 mil. lats in October), dropping 26.1% year-on-year by the end of the month. Outside credit institutions, cash currency in the amount of 778.8 mil. lats was still in circulation. The return of cash currency to banks promoted a rise in household deposits – on the account of a rise in current account balances, they grew for a ninth consecutive month. The deposits of private businesses increased only in the demand deposit sector, whereas term deposits continued on the declining trend. More rapid, particularly in the household sector, was the rise in lats deposits, pointing to an impact of returning cash currency. The accounts of businesses were increased both with lats and foreign currency, reflecting both growing domestic consumption and export activities. All factors combined to effect a total amount of deposits with banks at the end of October (5.8 billion lats) that was the highest ever observed.

Illustration. Year-on-year changes in some money indicators (%)

Source: Bank of Latvia

The drop in banks' domestic loan portfolio was smaller in October than in September, because the drop in loans granted to non-financial businesses was slower than before (only 0.5%). The impact of the base factor, however – the minimal drop in the loan portfolio in October of last year – increased the overall rate of year-on-year decline in loans to 8.2%.

Money supply will remain stable also in the coming months, hovering slightly above last year's level, with the rise of funds in bank accounts balancing the drop in cash currency in circulation. The financial situation of households will remain positive – the rise in employment and salaries, along with the impact of the decline in cash lats will ensure increased deposits with banks. The rise in private consumption fives rise to expectations of a rise in business deposits, which, in case the situation improves also in the area of external demand, could be remarkable. The question of using resources accumulated by banks in lending still remains open, however: at the moment, disposable funds in great amounts are kept in accounts in the central bank or are placed in foreign countries and most of this money probably will not be circulated in the domestic economy next year either. Yet after the euro changeover it would be natural for the evaluation of credit risk involving successful enterprises to diminish and the demand for loans from such enterprises to go up, thus there is reason for more optimism regarding lending to business activity next year.

Textual error

«… …»