Money indicators slightly down in May

The drop in the money indicator level in May was primarily caused by the drop in state enterprise deposits with banks, as they made payments to the budget for using the state capital (dividends). Deposits of private businesses grew on the other hand, both as a result of successful economic development and as the consumption by households grew under the impact of positive confidence indicators. Albeit in absolute numbers the total balance of domestic deposits shrank slightly, the rate or their annual growth increased to 9.5%. The balance of loans granted by banks diminished slightly as the loans granted to non-financial corporations and households continued to shrink and those granted to non-bank financial institutions continued to grow.

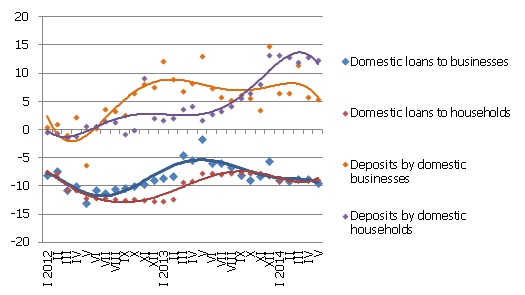

The deposits of businesses and households dropped in May by 0.2%, with the deposits by state enterprises shrinking by 12.3% and those of households by 0.4% and the funds of private businesses with banks growing by 2.3%. The annual rate of increase of household deposits in May was at 12.3% and the corresponding indicator for nonfinancial businesses was 5.4%.

As for the changes in the Latvian contribution to the common euro area indicator M3, the overnight deposits of euro area residents with the Latvian credit institutions dropped by 0.7% in May and deposits with the maturity of up to 2 years by 0.8%, whereas deposits redeemable at notice increased by 2.2%. With the amount of cash currency in circulation diminishing, the overall Latvian impact on the euro area money supply was reducing.

In May the portfolio of domestic loans granted to businesses practically remained unchanged; an increasing influence was still exerted by the rise in the crediting by financial intermediaries while loans granted to households dropped by 0.5%. The indicator of the annual rate of drop for loans in May was 8.3%, including the loans to businesses shrinking 7.9% year-on-year and those granted to households by 8.9%.

Illustration. Year-on-year changes in some money indicators (%)

Source: Latvijas Banka

The dynamic of both domestic consumption and export will continue to promote a rise in deposits by businesses, while the continuing positive consumer confidence could stimulate a certain drop in household accruals. In the final result, we will probably see an overall stability in accruals placed with banks, with the rate of their annual growth remaining moderate. The geopolitical factor remains, however: even though it has not been influencing money indicators to a substantial degree, with the situation deteriorating, households might raise their deposits for reasons of caution, whereas those of businesses might diminish.

Crediting trends over the next year could be impacted by at least two factors. Banks could be urged to be more active in lending to the economy by the European Central Bank's (ECB) resolutions on setting negative interest rates on deposits with the euro area central banks and supplemental long-term financing to banks for lending to the private sector (See ECB press conference of 5 June). On the other hand, the planned amendments to the Insolvency law and introduction of the "principle of returned keys" in lending would reduce the importance of collateral. Under the impact of the former factor, we can expect positive developments in lending to business activity, whereas the latter is likely to hinder activating lending to households.

Textual error

«… …»