Monetary aggregates stabilised

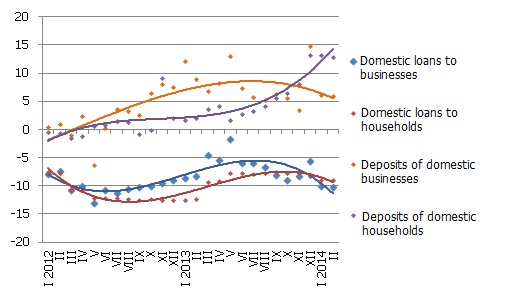

Money supply was stable in February, returning to moderate growth after the sharp increase in deposits at the end of 2013 and a seasonal drop in January 2014. At the same time data for February also confirmed that the euro changeover facilitated a new approach to investing the savings of households. As a result of household savings deposited on bank accounts in December and stored there throughout January, the level of household deposits remained high also in February. As regards lending, February saw a return of the long-established trend of moderate decrease in the loan portfolio, following an accelerated fall on account of structural changes in January.

In February corporate and household deposits posted a slight increase, with household deposits expanding moderately and those of companies remaining broadly unchanged. The annual growth rate of household deposits remained high (12.9%) while corporate deposits exceeded the level observed in February 2013 by 5.4%.

As regards changes in Latvia's contribution to the monetary aggregate M3 of the euro area, in February overnight deposits of euro area residents with Latvian credit institutions decreased by 1.5% and those with an agreed maturity of up to 2 years fell by 2.4%, while deposits redeemable at notice posted a slight increase. As a result of a decrease in currency in circulation as well, Latvia's overall impact on the euro area money supply was slightly on the downside.

In February the domestic loan portfolio of credit institutions shrank by 0.4%, with loans to non-financial corporations and households decreasing by 0.3% and 0.5% respectively. The annual rate of decrease in lending stood at 9.5% in February; however, excluding the data of two banks who had waived their licences in January, the annual rate of decrease in lending was a mere 3.6%.

Chart. Annual changes of selected monetary aggregates (%)

Source: Latvijas Banka

Despite the fact that the domestic factors are likely to be favourable for the economic growth and have a positive impact on the deposit expansion in 2014, their rate of increase will be moderate. External risks, particularly the conflict between Ukraine and Russia and the international community's response to it, are likely to dampen income from exports, thus hindering the deposit growth. On the other hand, the uncertainty of the situation might increase savings on bank accounts (particularly in the household sector). At the same time such situation will in a way freeze the expected lending growth.

Textual error

«… …»