Monetary aggregates are on sick leave

Both the received deposits and granted loans showed signs of decrease in the first two months of the year. With slower economic growth reducing the profitability of businesses, domestic deposits declined seasonally in January, and their minor rise in February did not allow for a return to the level of December. Continuing the trend observed in the previous months, the domestic loan portfolio of banks also decreased in January and February. Banks' conservative lending policies and the growing caution with which businesses view the economic outlook were accompanied by one-off factors, i.e. the changes in the classification of institutional sectors (a row of state and local government commercial companies were included in the general government sector as of 1 January) seen in January and the cancellation of the AS PNB Banka's licence in February.

The situation has abruptly changed in March. The increasing impact of the coronavirus outbreak on both the global and Latvia's economies leads to significantly reduced opportunities for businesses and households to make savings. Consequently, deposits with banks will follow a downward trend. With creditworthiness deteriorating and cash flow gaps occurring, the loan portfolio is also most likely to decrease further; however, the negative economic effects of the virus outbreak could be mitigated by wider fiscal policy support, inter alia, the government support measures for businesses and their employees. At the same time, ultra-accommodative monetary policy and the flexible approach of the banking sector to debt restructuring will help handle liquidity problems and ensure favourable financing conditions to economic agents.

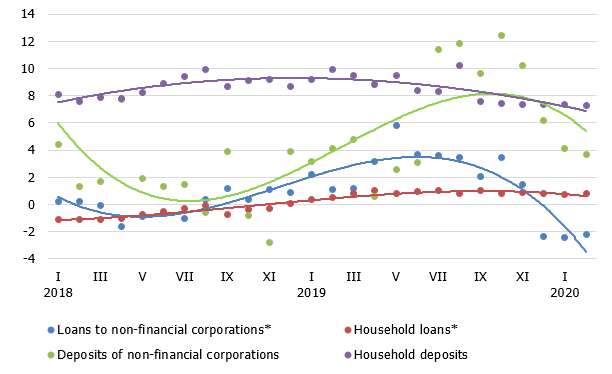

Returning to the actual data for the beginning of this year, the domestic loan portfolio shrank by 1.7% in January and February, with loans to non-financial corporations and households contracting by 2.9% and 0.2% respectively. As a consequence, in February the annual rate of change in domestic loans (excluding the impact of the banking sector structural changes and the changes in the classification of institutional sectors) stabilised in negative territory at –1.4% for loans overall and –2.2% in the case of loans to non-financial corporations. A marginally positive annual growth rate was reported only in lending to household (0.8% including 1.2% for loans for house purchase). The dynamics of new loans was rather weak; however, they showed a slight improvement – the amount of new loans granted in February posted an increase compared to January and even the same period a year ago.

In January and February, domestic deposits edged down by 0.8%, including a 2.0% decline in deposits by non-financial corporations and a 0.3% increase in household deposits. As a consequence, in February the annual growth rate of domestic deposits accounted for 6.4%, including those of non-financial corporations and households at 3.7% and 7.3% respectively.

Annual changes in domestic loans and deposits (%)

* For the sake of comparability, the one-off effects related to the restructuring of Latvia's banking sector have been excluded.

Textual error

«… …»