Manufacturing output still growing despite global tensions

According to the Central Statistical Bureau, manufacturing output grew again in July. According to seasonally adjusted data, it grew 0.7% month-on-month and, according to calendar adjusted data, 10.8% year-on-year. Compared to the corresponding period in 2010, manufacturing output grew 13.7% in the first seven months of the year.

An annual growth was maintained in July in the production of following industries: wood and wood products (+0.7%), fabricated metal products (+36.6%), furniture (+9.9%), non-metallic mineral products (+19.2%), wearing apparel (+26.3%) as well as computer, electronic and optical products (+10.3%). A simultaneous drop was observed in the production of pharmaceuticals (-7.3%), chemicals (-18.7%), food (-0.7%), and textile products (-14.8%).

The manufacturing turnover index in June grew 2.3% month-on-month (seasonally adjusted data), including by 3.6% in the domestic market and 1.0% in export. Thus there continued the recently observed trend of industrial production volumes growing in the domestic market slightly faster than in exports. That is quite natural, since with salaries growing, private consumption is gradually reviving as also indicated by the good retail turnover data from the last three months. Externally, however, uncertainty continued on the rise and the latest indicators suggest deterioration of the economic situation both in many European countries and elsewhere in the world. Since the beginning of the year, sales of manufacturing production domestically have grown 11.1% but in exports by 9.8%.

The Latvian industry confidence indicator aggregated by the European Commission, however, dropped 3.4 points in August, the greatest drop for this indicator since the beginning of 2009. The main reason for this deterioration is the worsening manufacturers' evaluation both for the output volumes observed in the last three months and for the volumes projected for the coming months. Thus Latvian manufacturers too are gradually beginning to feel the tensions in the world's financial markets and are concerned about the economic situation in Europe. This deterioration in confidence should probably be considered a psychological reaction for now because the volumes of new orders still suggest the opposite: in July they grew substantially and in the next few months industrial workloads could be adequate. Yet an improvement in the statistics of new orders does not always materialize in an increased output, since recalls and delayed payments etc. are possible.

In the next few months it will be external developments that will primarily determine the development of Latvian manufacturing. The majority of preliminary indicators point to a gradual "cooling off" of the global economy, which could translate into reduced external trade and industrial production output volumes in the second half of this year. The PMI and the European Commission's August industrial confidence indicators in most countries pointed to a possible drop in industrial output volumes in the next few months. A cause for optimism is the fact that the deterioration of the operational indicators of Latvian manufacturing is considerably more moderate than the European average. Two factors may be an explanation for this. First, the crisis has forced many Latvian enterprises to reorient production from niche to innovative products whose demand is less dependent on the ups and downs in the economy. Second, the economic indicators of East and North European countries (GDP, trade and industry dynamics) seem to suggest a "two-speed" development in Europe. While the countries in the European South are suffering the consequences of their high indebtedness, the economic indicators in the North are rather stable. For now that helps Latvia to maintain its manufacturing output growth, but in the next few months we will probably be unable to avoid a reduction in output volumes – for at least as long as Europe has not found a solution to its debt crisis and industrial confidence has not improved.

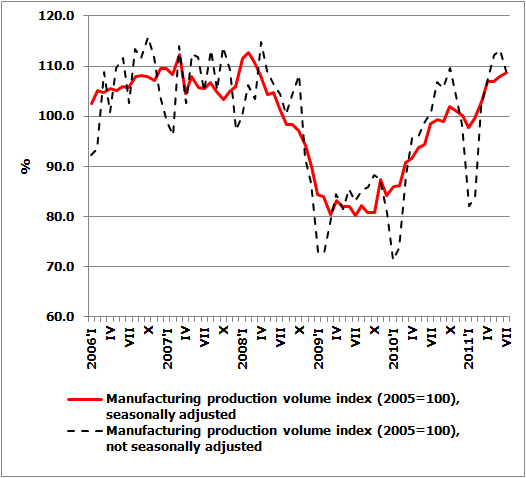

Figure 1. Dynamics of manufacturing output

Textual error

«… …»