Manufacturing ends the year on a positive note

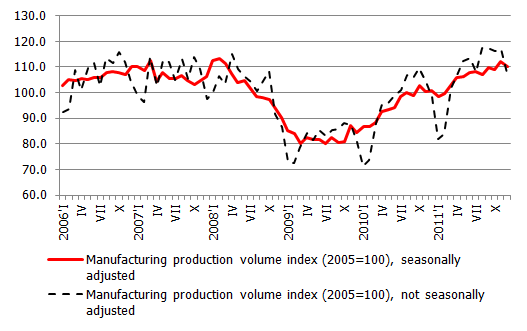

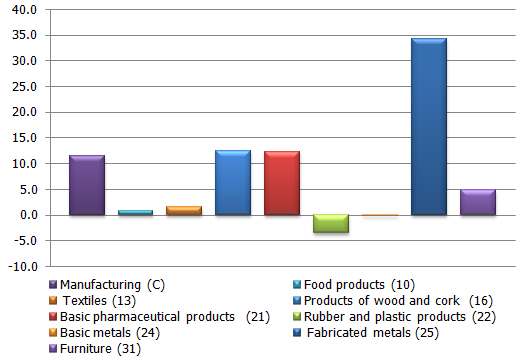

According to the data of the Central Statistical Bureau, the manufacturing production output in December 2011 dropped 1.6% month-on-month (seasonally adjusted data) but grew 9.6% year-on-year (calendar-adjusted data). That means that in 2011 overall manufacturing production volumes grew 11.5%. Strong industrial growth, which had a substantial effect on the annual result as well was observed in the second quarter of last year. In the second half of the year industrial growth continued, albeit more moderately. Examined by manufacturing sub-branch, the overall growth in 2011 was determined by the production of wood and wood products (12.4% growth in 2011), fabricated metal products (34.2%), wearing apparel (28.1%), non-metallic mineral products (23.9%), and electrical equipment (48.1%). The growth rate remained negative in 2011 overall only in the production of chemicals and chemical products (-3.5%), paper and paper products (-3.0%), and beverages (-6.3%).

The confidence indicators calculated by European Commission have once again improved substantially in January. The manufacturer confidence in January rose by 2.9 points. In a breakdown by sub-branch, confidence has improved in food manufacturing, the production of non-metallic minerals as well as the production of metals and fabricated metal products and furniture. A substantial deterioration has been observed in the evaluation of order amounts in the production of wood and wood products (by 18.9 points), and pharmaceuticals (-15.4), whereas there has been an improvement in the evaluation of order amounts in furniture production (+14.6). The expectations regarding price levels are continuing downward in the wood industry and metal production, but are on the rise in the production of non-metallic minerals, for the most part construction materials. An improvement in the index was observed January in Europe at large as well.

This month saw the publication of the full load of production capacity indicators for the first quarter of 2012; at 68.3% they have not changed substantially (68.2% in the fourth quarter of 2011). It is interesting to note that the load of production capacity has increased in all the main sub-branches of manufacturing: in the production of wood and wood products, basic metals, chemicals, fabricated metal products, and food production. A drop has been observed in the production of textiles and wearing apparel (probably the result of recent trends of appreciation of raw material prices), in the printing and publishing industry, the production of paper and other transport vehicles.

There are no big changes in the distribution of industry limiting factors. The majority of respondents still consider insufficient demand as the main factor limiting development. Yet a trend that has been in place as of the beginning of 2011 is continuing: ever more respondents admit that there are no limiting factors whatsoever. The greatest percentage of such replies has been observed in wood industry (33.7%), metal production (39.6%), and the production of fabricated metal products (31.7%). These are the growth leaders in manufacturing for 2011. Workforce as a comparatively important factor is mentioned in the production of textile products (10.1%) and wearing apparel (18.2%). These are the sub-branches in which a sharp lack of workforce as a very important factor in limiting the growth of the relevant enterprises is mentioned most often.

2011 in manufacturing can be considered a successful year: the growth rates in most sub-branches are positive. What can be expected for the branch in 2012? First, manufacturing overall will be impacted by the developments in the global markets, i.e. the slowdown of growth in Europe already pointed to by a variety of preliminary data. Moreover, in the last few days several countries have come out with announcements about a negative GDP growth in the fourth quarter of 2011. It is possible that the shrinking of Latvian manufacturing in December is a reaction to the drop in external demand in Europe. The situation in Europe lacks clarity, and substantial downward pointing risks remain to the development of its economy. Should they materialize, Latvia too will be affected. Thus in the next few months the external demand will remain moderate and no rapid development is expected in manufacturing. Some cause for optimism is provided by the latest PMI (Purchasing managers index) index and the confidence indicators of the European Commission. Some improvement in them has been observed in January. That means that if Europe is spared more turmoil and confidence is restored in the financial markets, 3-4 months later the above indicators may have a positive effect on Latvian industry.

The situation will of course differ by manufacturing sub-branch and enterprise. Negative price adjustments are possible in the wood product and metal markets. That would likely have a negative effect on the production volumes of these branches. In the metal industry and other branches of mechanical engineering several substantial investment projects are expected this year. The development of the branch will depend on carrying out these projects. The food industry cannot hope for a substantial rise in domestic sales and thus the growth potential for the branch will remain the export markets in 2012 as well. The competitiveness of the wearing apparel and textile branch will be determined by the fluctuations in the prices of raw materials and the ability of the branch enterprises to successfully operate in such conditions. If Europe does not solve its financial problems fast, it can be expected that the growth in added value in manufacturing will be lower in 2012 than in 2011.

Fig. 1. Manufacturing dynamics

Fig. 2. Rates of growth in the branches of manufacturing in 2011, per cent (calendar-adjusted data)

Textual error

«… …»