Manufacturing continues to triumph

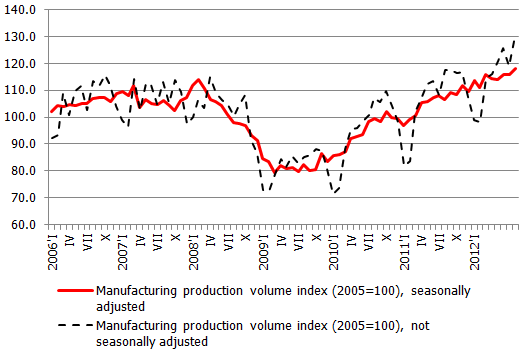

According to the data of the Central Statistical Bureau, the amount of manufacturing production in August grew 1.9% (seasonally adjusted data at constant prices). The historical data have been adjusted somewhat, which means that manufacturing has been growing for a third consecutive month. The annual rate of growth increased up to 10.9% compared to previous months.

August saw a substantial rise (seasonally adjusted data) in the production of wearing apparel (+15.9%), non-metal minerals or construction materials (+6.7%), computers, electronic and optical equipment (+8.5%), as well as the production of equipment, mechanisms and working machinery (+17.6%). The production of other transport vehicles, which primarily involves the production of ships and rolling stock and previously has demonstrated very serious fluctuations in terms of production volumes, meanwhile grew 96.9%.

The production volumes went down in the manufacturing of textile products(-6.2%), metals (-7.1%), fabricated metal products (-2.2%), as well as electrical equipment (-1.6%). Yet the greatest negative surprise was again presented by pharmaceuticals as the production volumes dropped by 29.5% in August. The greatly uneven performance in the pharmaceuticals branch observed this year is hard to explain – possibly, the production cycle has been changed in one of the big pharmaceuticals businesses, which could then have this impact on the overall data. The overall recent trend in the pharmaceuticals industry, however, does not leave much room for optimism.

In mining and quarrying the production volumes grew by 5.6% and in the energy branch by 0.5%.

The likelihood that manufacturing production volumes may continue to grow was already suggested by the confidence indicators aggregated by the European Commission, which, despite developments in the global economy continue to point to a positive mood among manufacturers (in August, manufacturers’ outlook improved by 2.0 and in September by additional 1.6 points). Both in August and September the manufacturers’ evaluation regarding the output volumes to be expected in the coming months grew substantially while the stock levels once again returned to negative territory, thus indicating to a small lack in stocks usually characteristic of growth periods.

In combination with the sustained export performance, Latvian manufacturing continues to give rise to optimism. At a time when European economic growth is sluggish, Latvian manufacturing continues to grow. It is not only the result of the so-called base effect: through greater and smaller drops, manufacturing has been growing all this year and the branch has exceeded the results of the record month of the pre-crisis period for the fourth time.

Moreover, manufacturing continues growing under a complicated set of circumstances regarding the global economy: as a result of improved competitiveness, Latvian exports have managed to win greater market shares in the imports of our trading partners. The manufacturing production has also become more diverse. In 2007, manufacturing accounted for 10.4% of GDP at real prices whereas in 2012 its share will already be within the 13-14% range, thus inching toward the goal set by the national industrial policy of 20%.

If we compare the output volumes of manufacturing in the first eight months of 2012 with the corresponding period of 2007 (it was the year with the highest manufacturing output in the pre-crisis period), we see a 10.5% growth. If the trade and service branches are still lagging behind pre-crisis levels, manufacturing have surpassed those levels and the importance of this branch has gradually increased. At the moment, it is a branch that, along with trade and transportation, determines the overall economic growth. With this in view, given the growth in manufacturing output volumes and good trade turnover data of the previous months, it can already be predicted with some certainty that gross domestic product will continue on the path of growth in the third quarter as well.

The developments in the global markets should of course be kept in mind, but negative news from Europe have been reaching us for quite some time now and it has had no substantial impact on Latvia’s economic indicators. If there is no new, even greater turbulence in Europe, then we may survive this debt crisis in Europe relatively easily, without substantial drops in output. At the same time, we should not rest on our laurels: we must continue work on the most important aspects for manufacturing: labour problems (the lack of highly skilled employees in some sub-branches of manufacturing), various infrastructure limitations and lack of financing.

Dynamics of manufacturing output volume index, (2005=100)

Textual error

«… …»