Manufacturing continues to surprise with its resistance to external turmoil

In the course of 2011, the dynamic of manufacturing was fluctuating yet with a prominent upward trend determined both by the hitherto persistent external demand and the regained competitiveness of the branch. Toward the end of the year the upward trend gradually began to slow down as a result of weaker demand in external markets and increased uncertainty. It can be expected that in the coming months the situation will be expressly subject to fluctuation and possibly even with a slight downward trend.

Despite global developments, the amount of manufacturing production in November 2011 increased 3.2% month-on-month (seasonal effects excluded) and a 12.1% year-on-year growth was maintained. The volumes of manufacturing production in an 11-month period grew 11.7% year-on-year. A substantial month-on-month increase in the November production volumes (seasonal effects excluded) was posted in the production of chemicals (+52.0%), pharmaceuticals (+19.6%), non-metallic minerals (+14.7%), fabricated metal products (+10.2%), and furniture (+4.3%). It must be noted however that the majority of the above branches (and in particular the chemical and pharmaceutical industries) have historically been subject to rather serious fluctuations.

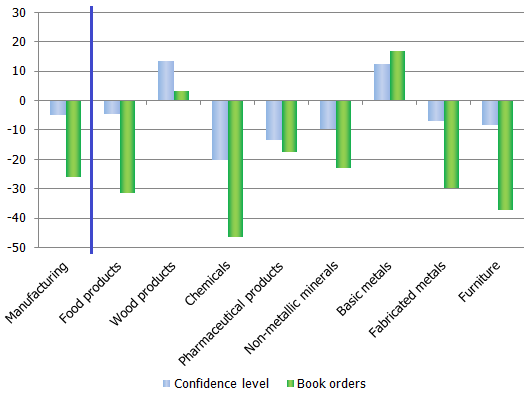

The overall industrial entrepreneur confidence indicator evaluated by the European Commission has not been deteriorating substantially in recent months, yet it remains slightly under the average for 2011. Yet in breakdown by sub-branch, it is obvious that there are wide differences. Confidence levels remain best in the production of wood pulp and wood materials as well as metals, whereas these levels are down in the production of chemical products, which reflect recent overall trends in manufacturing: the better the confidence levels, the better the performance. It is possible that the optimism of wood producers is based on the relatively high level of investment that the branch received in the third quarter (non-financial investment was at 36.0 mil. lats). These investments will not only let the manufacturers increase the volumes of their production but also increase the range of products and their cost-effectiveness. It is the sub-branches of the manufacturing of wood and wood products, metals and fabricated metal products that have been making the greatest contribution to the growth of the manufacturing branch whereas the chemical industry posted rather low production volumes in recent months.

The results achieved in manufacturing in recent months have been quite impressive, yet future prospects in the industry will be determined by the depth of the recession in Europe. It was already in the third quarter of 2011 that the GDP of some countries (Belgium, Czech Republic, Denmark, Ireland, Cyprus, the Netherlands, Portugal and Slovenia) shrank, yet these countries are not among the most important trading partners of Latvia and thus the impact may not be substantial for a while. In all likelihood, some countries can expect negative GDP growth rates in the fourth quarter as well, yet the important question is what will happen in 2012? At the end of 2011, the majority of flash estimates regarding the global situation were pointing downward. Thus the EU-27 business confidence indicator deteriorated for four consecutive months starting with August. The Purchasing Managers Index (PMI) likewise suffered substantial drops in almost all of the world's economies of scale. Yet the first PMI indicators of the year pointed to some evidence of stabilization in December (in Germany, France, Italy, Japan, Russia etc.). That is hardly an indication that the newly expected recession is over without really starting but lets us suppose that the drop in economic activity or recession will not be as substantial as at the end of 2008 and beginning of 2009. Moreover, several important decisions regarding the possible actions to be taken to resolve the debt crisis have been taken, which may provide a positive impulse for the European economy; all that remains is to implement these decisions.

The evaluation of new order amounts in most sub-branches of manufacturing remains negative in Latvia. It is most likely that in the coming months we will see a drop in the amounts of manufacturing production in Latvia as well, yet how long it will last will be determined by global developments. What shall we do in the meantime? One thing would be to not be over optimistic regarding our growth predictions for 2012. When drawing the plans for development, we should exercise caution in order not to get burned again (that applies both to the Government and the corporate sectors).

The confidence level in some manufacturing sub-branches and evaluation of new order levels in 11 months of 2011, %

Textual error

«… …»