Loan portfolio contracted also in January

Meanwhile, deposits with banks, including those from the corporate sector, continued increasing in January, while households started to spend their seasonally high income received in December and, consequently, their deposits declined.

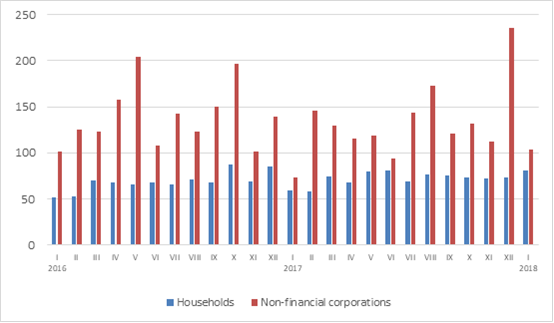

Domestic loan portfolio shrank by 0.1% in January, with the loan portfolio of non-financial corporations decreasing by 0.6% and household loans contracting by 0.2%. Only loans to non-bank financial institutions posted an increase. Although the amount of new loans lagged behind the level of December, it still significantly exceeded that of January 2017, with loans to non-financial corporations and those to households increasing by 41.8% and 35.9% year-on-year respectively.

Domestic deposits with banks grew by 0.4% in January, inter alia, deposits of non-financial corporations increased by 1.3% but those of households shrank by 0.7% posting an annual growth rate of 4.4% and 8.1% respectively.

With deposits on the rise, Latvia's contribution to the monetary aggregate M3 of the euro area continued increasing by 0.6%, with the annual growth rate standing at 5.9%. Overnight deposits of euro area residents with Latvian credit institutions, deposits with an agreed maturity of up to 2 years and deposits redeemable at notice expanded in January, with their annual rates of change posting 8.8%, –15.7% and 7.9% respectively.

New loans (millions of euro)

The downward trend in the loan portfolio contrasts, to a certain degree, with the optimistic statements of banks regarding the situation in the lending sector. The information obtained in the euro area bank lending survey on growing demand for loans to both enterprises and households in the fourth quarter of 2017 and an expected increase in demand also in the first quarter of 2018 suggested more activity in the sector. Nevertheless, the increase in new loans is starting to reflect the positive market assessment. The current financial sector turbulence will only have a significant impact on non-resident deposits; therefore, domestic deposits are expected to continue to follow a moderate upward trend.

Textual error

«… …»