Lending rise stabilizes

Growth in both lending to nonfinancial enterprises and consumer lending remains stable. A drop, usual for the first month of the year, was observed in the amount of deposits attracted: there was a moderate drop in the deposits by nonfinancial enterprises and households and a faster one in the deposits by enterprises of financial mediation with banks.

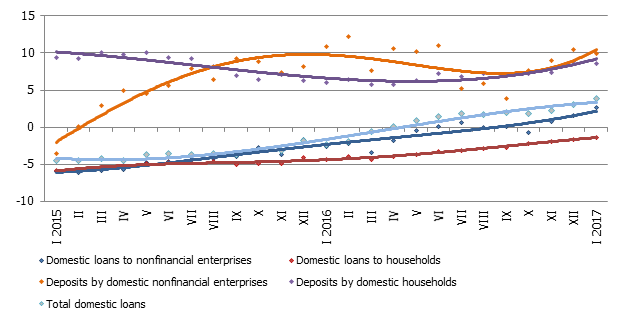

The balance of domestic loans in January increased by 0.2%, with loans to nonfinancial enterprises rising by 0.2% and consumer loans to households by 1.5%. The loans granted to financial institutions also increased whereas a small drop continued to be the case in housing loans. The indicators of year-on-year changes in domestic loans continued to improve substantially: the overall rate reached 3.8%, with the loans to nonfinancial enterprises increasing by 2.6% and consumer loans to households by 8.4% year-on-year. With housing loans dropping by 1.8% year-on-year, the total 12-month rate of drop in household loans improved to -1.4%.

The domestic deposits attracted by banks dropped in January by 2.6%, with their 12-month rate of growth at 6.0%. Deposits by nonfinancial enterprises shrank by 2.9% (y-y growth rate at 9.9%) and household deposits by 0.7% (y-y growth rate at 8.6%), with the deposits of both sectors remaining substantially above the November level.

Resulting from the drop in deposits, Latvia's contribution to the euro area total money supply indicator M3 also dropped in January (by 2.0%; with the y-y rate of growth at 6.1%). The overnight deposits with Latvian credit institutions by euro area residents diminished by 2.2% and deposits with set maturity of up to two years by 4.6% while deposits redeemable at notice increased by 2.4%.

Y-y changes in some money indicators (%)

A moderate economic growth and rising incomes along with cautious spending will continue to ensure a moderately fast increase in deposits. It all also points to growing lending – in the second half of the year, the currently growing areas of enterprise and consumer lending will probably be joined by lending for housing. The main factors fostering growth will be growth of the real estate sector, the state programme for support of families with children and other programmes with the help from the development financial institution ALTUM and from the supportive monetary policy of Eurosystem with its low interest rates. More active inflows of financing from EU funds could also have a positive impact on lending, although it is still not clear whether a full uptake of these funds will begin already this year.

Textual error

«… …»