Lending remains subdued, whereas deposits are growing

Latvia's economic growth continues to rely primarily on businesses using their internal sources of finance, while the increase in the contribution made by banks in the form of lending to businesses and households remains negligible. At the same time, domestic deposits continue to grow both in monthly and annual terms.

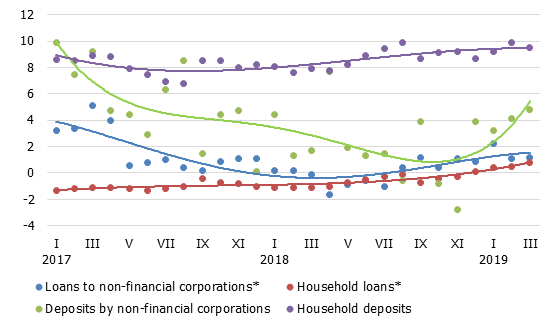

In March, the loan portfolios of both the non-financial corporations sector and the household sector expanded (by 0.3% and 0.1% respectively), with household loans for house purchase and consumer credit rising by 0.1% and 0.6% respectively. Yet the overall rise by merely 0.1% was negligible and the annual rate of change in domestic loans remained broadly unchanged at –4.0%, including –4.7% and –4.8% rates of change in the case of loans to non-financial corporations and household loans respectively. At the same time, the effect from the banking sector restructuring excluded, the annual rate of change in all sectors remained overall positive at 1.4%, including 1.2% and 0.8% increases in loans to non-financial corporations and household loans respectively. There was a slight improvement in new loans in March, with the monthly amounts of new loans granted to both businesses and households reaching the highest level since the start of the year. As a result, the amount of new loans granted in the first quarter of this year caught up with that of the respective period of the previous year.

Domestic deposits by non-financial corporations and households expanded by 4.8% and 9.5% in annual terms respectively in March, with the overall annual growth of deposits reaching 7.8%. Latvia's contribution to the monetary aggregate M3 of the euro area increased by 0.9% on account of overnight deposits of euro area residents with Latvia's monetary financial institutions, despite the shrinking deposits with an agreed maturity of up to two years and deposits redeemable at notice: the annual rate of change in M3 was 13.8%, whereas the respective rates for the above deposit categories were 15.4%, 13.2% and –0.4%.

Annual changes in domestic loans and deposits (%)

* For the sake of comparability, the one-off effects related to the restructuring of Latvia's banking sector have been excluded.

The bank lending survey conducted in March suggests a slight tightening of the credit standards and terms as well as reveals expectations of a further tightening. No growth is reported in the demand for loans to enterprises, which could be related to the potential external risks. At the same time, household demand for loans has increased. However, banks remain cautious regarding the future growth prospects in this sector as well. Despite all that, it is highly likely that the loan portfolio will continue to expand modestly.

Textual error

«… …»