Lending remains sluggish

For the economy to develop in the circumstances when the external demand is shrinking and growth is decelerating, availability of bank loans for making productive investment and financing current assets to support shorter-term cash flows is extremely important. Availability of housing loans and consumer credit is also important in the context of stimulating the domestic demand. In response to the slowdown of the euro area growth and weak inflation outlook, this month the European Central Bank (ECB) adopted several measures aimed at supporting the growth of the euro area economy, inter alia activating lending.

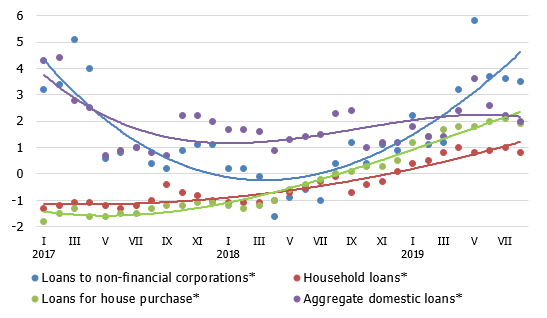

Whether the new monetary stimulus will also jump-start Latvia's economy remains yet to be seen; however, looking at the opportunities provided by the ECB's highly accommodative monetary policy to date, the overall conclusion is that this potential has not been fully used in Latvia so far, as bank lending remains sluggish. Monthly developments in outstanding loans have been volatile and the annual rate of change in the domestic loan portfolio remains low (2.0% in August). New lending is also stagnating, with the August volume significantly lower both month-on-month and year-on-year, and the aggregate amount of new loans granted over the first eight months of the year also 4.2% smaller than a year ago.

Domestic loan portfolio expanded by 0.5% in August, whereas the annual rate of growth declined by 0.2 percentage point, with the loan portfolio of non-financial corporations moderately growing and that of households remaining broadly unchanged. The annual growth rates of loans to non-financial corporations and loans to households decreased to 3.5% and 0.8% respectively. At the same time, new loans to non-financial corporations shrank by 45.7% month-on-month and by 44.3% year-on-year in August (by 7.0% and 18.3% respectively in the case of household loans).

Formally, domestic deposits grew by 1.6% in August. This, however, includes the guaranteed compensations disbursed to the customers of the shut-down AS PNB Banka and credited by the Deposit Guarantee Fund to accounts in other banks in August. The temporary statistical effect of those deposits excluded, the monthly growth rate of deposits remains close to 1%. Latvia's contribution to the monetary aggregate M3 of the euro area increased by 1.1% in August, with overnight deposits of euro area residents with Latvia's monetary financial institutions, deposits with an agreed maturity of up to two years as well as deposits redeemable at notice expanding. The annual growth rate of M3 reached 10.2% in August, whereas the above deposits posted increases of 9.9%, 20.3% and 4.2% respectively.

The annual rate of change in domestic loans (%)

* For the sake of comparability, the one-off effects related to the restructuring of Latvia's banking sector have been excluded.

The credit cycle is currently in an expansion phase; nevertheless, it is insufficient for development. Funding is, indeed, available and the costs are low, yet banks prefer holding their excess liquidity totalling over 4 billion euro in accounts at the central bank rather than financing the economy to improve its competitiveness and support domestic demand. Given the current uncertainties surrounding the global economic outlook, such a strategy is understandable, and it is more likely that no significant changes in lending patterns can be expected in the coming months. Nevertheless, a more vigorous pick-up in lending would be much welcomed.

Textual error

«… …»