Lending recovery stalling

A seasonally high increase was observed for household deposits with banks, whereas the deposits of non-financial corporations grew only marginally. This continues the last year's trend: the growth of household savings outpaces that of consumption, while imports and investment are expanding.

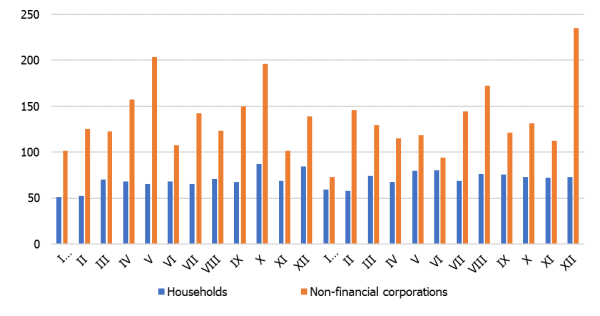

Domestic loan portfolio shrank by 0.5% in December, with the loan portfolio of non-financial corporations decreasing by 0.2% and household loans contracting by 0.6%. The shrinking of the portfolio was a result of the substantial write-offs of bad loans typical for the year-end as well as seasonal repayments of short-term loans. Although new loans to non-financial corporations reached a record high in December, this was also insufficient to offset the shrinking of the aggregate portfolio.

Domestic deposits with banks expanded by 1.8% in December, including increases of 3.2% and 1.4% in deposits by households and non-financial corporations, with their annual growth rates being 8.2% and 0.1% respectively.

With deposits growing, Latvia's contribution to the monetary aggregate M3 of the euro area also increased by 1.6%, with the annual growth rate standing at 3.2%. As in the case of domestic deposits, looking at the overall deposits by euro area residents with Latvia's credit institutions, a significant increase was reported for overnight deposits and deposits redeemable at notice (annual growth of 5.9% and 10.1% respectively in December), whereas deposits with an agreed maturity of up to 2 years contracted (by 21.1% in the course of 2017).

New loans (millions of euro)

Despite the fact that the borrowing terms applicable to households and non-financial corporations in the euro area have been accommodative for quite some time, lending growth remains subdued in Latvia. The current economic development is financed from the existing loan portfolio and own financing of businesses. In order to retain the economic competitiveness and achieve further growth, however, an adequate boost in lending will be essential.

At the moment, external demand is a contributing factor increasing the probability of a lending recovery in the near-term, while the domestic developments such as shortage of labour force and delays with the structural reforms could make banks and borrowers postpone their decisions in favour of lending.

Textual error

«… …»