Lending continues on a downward trend in November

On the back of persistently weak external demand and increasing caution of banks and businesses, overall lending indicators as well as those of corporate loans declined in November, with the housing loan portfolio being the only one posting the usual minor growth. Hence, the annual growth rate of domestic lending dropped to 0.8%, a low since 2017. Domestic deposits posted a slight fall in November, with corporate deposits shrinking, but household deposits moving up.

In November, the domestic loan portfolio shrank by 0.8% on account of a 1.4% decrease in loans to non-financial corporations and the household loan portfolio remaining broadly unchanged, i.e. with loans for house purchase and consumer credit edging slightly up and down respectively. Loan portfolio changes mostly resulted from repayments of previously granted loans and the weak dynamics of new loans: November saw a considerably lower amount of loans granted to businesses in comparison with October and a 9.2% fall in the first 11 months of 2019 compared to the same period in 2018; loans to households were granted in broadly the same amount as in the previous months of this year, but overall in the first 11 months of 2019 they dropped 4.7% compared to the same period a year ago.

Domestic deposits contracted by 0.2% in November, including a 2.3% decline in deposits by non-financial corporations and a 1.0% increase in household deposits. In November, similar to October, overnight and long-term deposits increased, but short-term deposits shrank. Latvia's contribution to the monetary aggregate M3 of the euro area grew by 0.1% in November, with overnight deposits of euro area residents with Latvia's monetary financial institutions and deposits redeemable at notice expanding, but deposits with an agreed maturity of up to two years contracting. The annual growth rate of M3 stood at 7.8% in November, whereas the above deposits posted increases of 8.4%, 2.9% and 5.4% respectively.

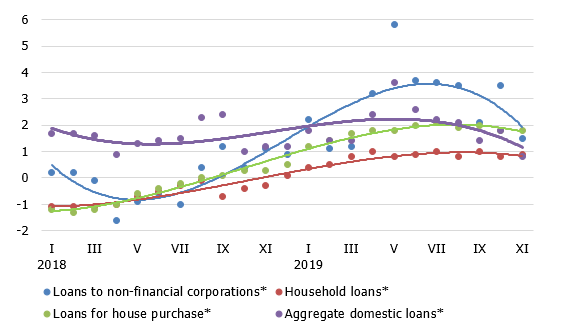

The annual rate of change in domestic loans (%)

* For the sake of comparability, the one-off effects related to the restructuring of Latvia's banking sector have been excluded.

The low level of interest rates continues to polarize deposits by purpose: for settlement, each month shows an increase in demand deposits; and for savings, long-term deposits are on an upward trend as their yields are relatively competitive. However, the share of the above deposits, i.e. approximately 2%, is rather small in total deposits. Meanwhile, short-term and medium-term deposits seem to attract increasingly less interest due to the extremely low interest rates and limited liquidity. Such a deposit structure is likely to last for a longer time as the era of low interest rates persists.

The former concern about the weak lending dynamics has materialised as the corporate lending decline cannot be offset by the minor rise in the housing loan portfolio. Although the household sentiment still remains quite cheerful, it has worsened in November. Given the rather pessimistic outlook by businesses, no noteworthy recovery in lending is likely to be expected in the next few months.

Textual error

«… …»