Lending to businesses is still ebbing

Following a short period of stability, the domestic loan portfolio dropped again in April, on account of the repayment of individual large loans granted to non-financial corporations, while loans to households remained almost unchanged. Both businesses and households significantly increased their domestic deposits, with their annual growth rate moving up by 1.2 percentage points and reaching 4.9%.

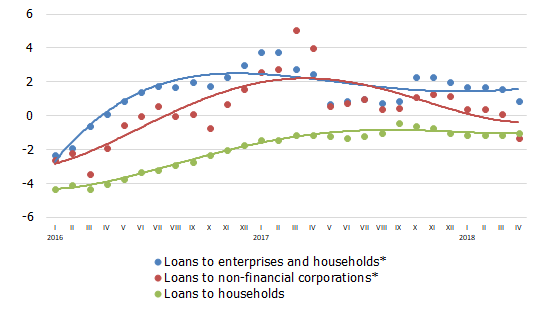

The annual rate of decrease in the domestic loan portfolio stood at 3.6% in April, with the annual decrease ratio in the loan portfolio of non-financial corporations reaching 10.2% (the annual rate of change in loans granted to non-financial corporations has become negative again, even excluding transfers of part of the loan portfolio of Nordea Bank Finland Plc to its parent bank). The annual change ratio in the loan portfolio of households improved slightly in April (to –1.0%), with loans for house purchase remaining unchanged, but consumer credits edging up somewhat. In April, new loans for house purchase and consumer credits posted slightly higher levels month-on-month, while new loans to non-financial corporations decreased by one third.

In April, domestic deposits with banks expanded by 1.7%, including increases of 3.7% and 1.0% in corporate and household deposits respectively, with their annual growth rates being 7.7% and 7.8%.

Latvia's contribution to the monetary aggregate M3 of the euro area increased by 1.2% in April, with its annual growth rate standing at 4.3%. Both deposits with an agreed maturity of up to 2 years by euro area residents with Latvia's monetary financial institutions and overnight deposits expanded by 7.3% and 0.7% respectively, but deposits redeemable at notice slightly decreased by 0.5% within a month.

The annual rate of change in domestic loans (%)

* To ensure comparability, the one-off effect has been excluded since September 2017 due to transfers of part of the loan portfolio of Nordea Bank Finland Plc to its parent bank.

The recent developments in the financial sector and less optimistic signals coming from the external environment suggest that the rise could moderate already in the nearest future, although, for the time being, economic growth continues to show convincing signs of an upward trend also without significant new loan investment. Considering that the problem related to insufficient capacities and, consequently, investment needs, but in the medium term – uncertainty surrounding the availability of the European Union funds in the next programming period – have also become increasingly pressing, it will be difficult to ensure long-term growth without rolling in a certain credit tide.

Textual error

«… …»