Increased diversification in manufacturing lowers future risks

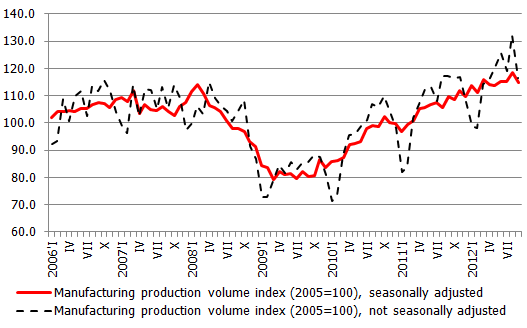

In September the amount of manufacturing production dropped 3.1% (seasonally adjusted data). The annual growth rate thus dropped to 4.5%. Despite weaker September results, the third quarter performance of manufacturing should be considered successful. Quarter-on-quarter, the production output increased by 1.6% (seasonally adjusted data) in the third quarter. Combined with the good indicators of retail trade, the good agricultural harvest and stable transportation data, this allows us to hope for a good flash estimate of gross domestic product (GDP) that is due this week-end.

The September drop in manufacturing was determined by a substantial drop in the production volumes of chemical substances and chemical products (minus 47.4%, seasonally adjusted data, month-on-month). The output of the chemistry sub-branch has been notably unsteady historically and fluctuations on this scale are very important, impacting the overall output of manufacturing. The sub-branch data can be explained by the characteristic fluctuations in the bio-fuel production market (this time the cause is a lack of raw materials) and it is likely that the next month’s figure will be similar but with a plus sign.

There was also a substantial drop in the output volumes of other transport vehicles production, which was to be expected because in this sub-branch as well data tend to fluctuate to a great degree and the data depend on the fulfilment of particular projects (last month there was a substantial rise in production output volumes). This is not to imply, however, that the negative contribution came from only these two sub-branches. Output volumes dropped also in the production of textiles, fabricated metal products, construction materials, computers and electronic equipment as well as furniture. It is now too early to say It is too early to judge whether such manufacturing data point to more serious problems or reflect an inadequate demand. A positive development is the September performance of the pharmaceuticals branch which has posted growth (plus 14.4%) as well as metal production (plus 6.2%); there has been a small increase also in the sub-branches of wood and wood products and foodstuffs.

Another positive sign is that every month there are new developments regarding the manufacturing production structure: some months, there is an increase in electrical equipment and transport vehicles, in other months it is pharmaceuticals and chemicals that are on the rise, in yet other months it is wood and wood products and construction materials turn. Such diversification of output lessens risks for the future. It is true, however, that investment activity has somewhat abated lately. If at the end of 2011 and beginning of 2012 there was talk of several important investment projects in manufacturing that later materialized in the statistics of non-financial investments, there is less of such information at the end of 2012: manufacturers are apparently adopting a wait-and-see stance, evaluating developments both in the global and domestic markets.

At the end of October, the latest European Commission industry confidence data became available. The confidence indicator in October dropped by a mere 0.2 points, which indicates stability in industry confidence. As of the beginning of the year, the industry confidence has thus not undergone substantial changes; despite small fluctuations it has held a stable position near “positive territory” and has persisted as one of the highest indicators in Europe. The quarterly survey data, however, give rise to some concern: there has been a substantial deterioration in the evaluation of new order volumes for the coming months. Predictions of full loads of production capacity for the fourth quarter have also dropped slightly: to 71.6% (72.0% in the third quarter). This change has been most pronounced for the production of beverages, textiles, printing and publishing as well as construction materials while increases have been predicted for the production of pharmaceuticals, chemical substances, metals and automobiles and other transport vehicles. Inadequate demand remains the main limiting factor for further development (37.7% of all respondents mentioned it as the main factor), yet the percentage of those manufacturers who consider that there are no substantial limiting factors is still high (27.3%).

In the first 9 months of the year the manufacturing output volumes have grown 10.0% year-on-year. The probability that in the year overall this figure will not be substantially lower is rather high. That means that the contribution of manufacturing to GDP growth will be among the highest and will continue to increase its proportion in the structure of total value added.

Textual error

«… …»