The impact of euro expectations becomes more pronounced

In August, total money supply increased, with the rise in deposits attracted by banks exceeding the drop in the demand for lats cash currency. The drop in banks' loan portfolio was minimal, with the rise in loans granted to enterprises almost balancing out the impact of repayment of loans and writing off of bad loans.

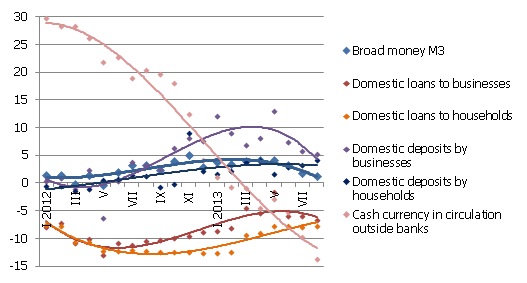

Money indicator M3, which characterizes the amount of cash and noncash currency in the economy rose by 0.4% in August, but the rate of its annual increase slowed down to 1.2%. The amount of cash lats in circulation continued to drop at an unchanged and rather rapid pace (by 33.5 mil. lats in one month), at the end of August dropping 13.7% year-on-year. Under the impact of less active use of cash currency and positive activity of the economy, the deposits of both domestic businesses and households grew, with the most important rise maintained in the overnight deposit segment.

Illustration. Year-on-year changes of some money indicators (%)

Source: Bank of Latvia

In August, the rise in euro deposits was notably more rapid (+2.3%), whereas the lats deposits grew only by 0.8%, indicating that the cash accruals in lats to a great extent end up in euro accounts in banks.

The total balance of domestic loans dropped by a mere 0.1% in August, for, as the housing loans dropped at their usual pace (by 0.5%), the balance of loans granted to businesses grew by 0.3%. As the banks continued to have their prolonged wait-and-see attitude, however, the total domestic loan portfolio still lagged behind the indicator of the corresponding period last year (by 6.9% in August), currently having reached the level of the end of 2006.

The rate of increase of money supply remains positive while continuing to drop. This has been affected and will be determined in the coming months by the drop of cash currency in circulation, because the rise in deposits attracted by banks is continuing and points not only to cash ending up in bank accounts but also to savings being replenished as the levels of business production and population income are rising. We can expect a moderate rise in deposits in the future as well, yet in lending, changing trends have not been observed. The rather weak demand for loans and the cautious lending policies of banks are not holding out a promise that the cycle of dropping lending is coming to an end.

Textual error

«… …»