To the hungry soul every bitter thing is sweet*

The September developments in the relationship between banks and loan recipients confirmed the truth of the old Biblical proverb 'to the hungry soul every bitter thing is sweet.' Even the small rise in granted loans, strengthening the health of the loan-hungry Latvian economy, could be considered a sweet morsel. In September, the total domestic loan portfolio, including the amount of newly granted loans, and lending to non-financial companies both grew. With the finances in bank accounts of enterprises on the rise, the balance of deposits attracted by banks also grew.

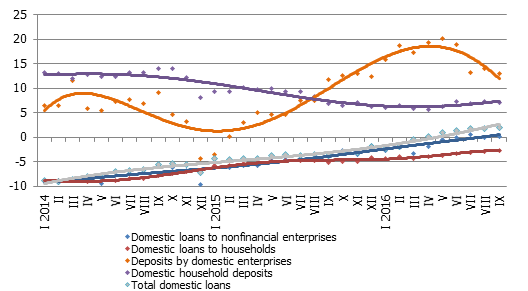

The balance of domestic loans in September grew by 0.2%, with loans to non-financial enterprises increasing by 0.1%, loans to financial institutions by 2.2% and consumer loans to households by 0.3%. For the fourth consecutive month, the balance of mortgage loans kept shrinking at the same (0.2%) rate. The 12-month rate of rise of domestic loans in September reached 2.0%, including 0.1% for loans granted to nonfinancial companies, whereas the 12-month rate of decrease in loans granted to households diminished to 2.7%. As for newly granted loans (excluding renegotiated loans), their amount in September increased by 12.3% month-on-month and by 34.7% year-on-year.

The domestic deposits attracted by banks in September grew by 0.1%, with their annual rate of growth at 9.7%. Enterprise deposits increased by 0.3% (annual growth rate at 13.0%) while household deposits remained practically unchanged (annual growth rate at 7.0%).

The Latvian contribution to the euro area common money indicator M3 grew slightly in September. The overnight deposits by euro area residents with Latvian credit institutions dropped by 0.1%, whereas deposits redeemable at notice increased by 1.2% and deposits with the set maturity of up to two years rose by 0.5%. The total Latvian contribution to the euro area M3 grew by 0.1%, exceeding the level of the same period a year ago by 9.0%.

12-month changes in some money indicators (%)

Source: Latvijas Banka

The resumption of lending growth and moderately maintained rise in deposits will foster further stability of the economy and investments necessary for continued economic growth. The survey of bank lending conducted in September 2016 also points to an encouraging situation in the loan market: in the third quarter and, predictably in the fourth quarter, the loan standards are unchanged, whereas the demand for loans both from enterprises and households increased in the third quarter and is expected to slightly rise in the fourth quarter. The overall mood of the market participants remains positive and the impact of the supporting monetary policy of the Eurosystem on the low interest rates will continue, therefore there are grounds to expect a further recovery of lending indicators. Meanwhile the 12-month growth of lending to non-financial enterprises has renewed and it is reasonable to expect a rise in lending to households next year. Growth of the enterprise loan portfolio will to a great extent be fostered by active use of European Union funds and resumption of lending to households by the lending support programme continued by the government; increasing activity in the real estate market and rising consumer lending.

* King James Bible

Textual error

«… …»