Household savings in banks on the rise

This suggests that the growth in wages has had only a partial effect on the consumption dynamic (the year-on-year rise in retail trade enterprise turnover is a mere 2-3%) while ensuring a significant rise in savings. The situation in lending was stable, with the domestic loan portfolio, loans to financial institutions and consumer loans to households increasing slightly, loans to nonfinancial enterprises remaining practically unchanged, and housing loans dropping somewhat.

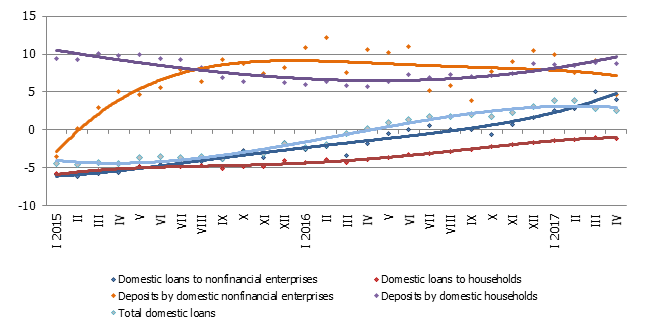

Domestic deposits attracted by banks increased in April by 0.6%, with their year-on-year growth rate at 4.0%. Household deposits meanwhile increased by 1.1% (year-on-year growth rate at 8.8%), and deposits by nonfinancial enterprises decreased by 2.1% (year-on-year growth rate at 4.7%).

Euro area residents' deposits with Latvian credit institutions grew relatively rapidly in April, and Latvia's contribution to the euro area money supply indicator M3 increased by 1.3% (year-on-year rate of growth at 5.9%). Their overnight deposits grew by 1.6% and deposits redeemable at notice by 1.4%, whereas deposits with set maturity of up to two years shrank by 0.4%.

The overall balance of domestic loans in April increased by 0.1%, including loans to financial institutions by 2.2% and consumer loans by 0.7%. The loan portfolio of nonfinancial enterprises, on the other hand, remained unchanged and housing loans dropped by 0.2%. The year-on-year rate of growth of domestic loans slowed down to 2.5% (4.0% for loans granted to nonfinancial enterprises), with loans granted to households remaining in the negative range, i.e. at –1.1%.

Y-y changes in some money indicators (%)

Source: Latvijas Banka

The actual data of recent months point to a very moderate recovery in lending, but in the second half of the year lending growth could accelerate, providing a greater stimulus to the growth of the economy. Along with the low interest rates on loans and the growing interest of entrepreneurs in carrying out development projects and attraction of investments under the conditions of stabilizing external demand, lending will also be fostered by several activities undertaken by the ALTUM financial institution. Here it is not just the state support programme for housing purchases that deserves mention but also a loan guarantee programme for small and medium businesses as well as the new support programme for loans targeted at building renovation. The increasing household savings in banks could also have a positive effect on the availability of loans, for instance, in the prospective borrowers coming up with the down payment as part of qualifying for a housing loan.

Textual error

«… …»