Household deposits on the rise

In March, the rise in household deposits already observed in the previous month continued, whereas the total money supply declined as the deposits of businesses with banks dropped. The domestic loan balance continued to shrink as a result of both repayment of short-term loans and a bigger volume of loans written off at the end of the quarter. The rate of year-on-year change in lending improved substantially (from minus 10.1% in February to minus 6.7% in March), because as of this month the base level was no longer affected by the indicators of “Parex banka”, which lost its licence in March of last year.

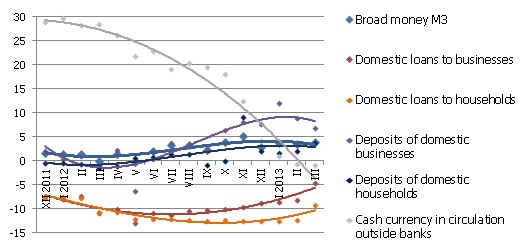

Money indicator M3, which characterizes the amount of cash and noncash currency in the economy, dropped by 1.4% in March while rising 4.0% year-on-year. Both domestic overnight deposits and deposits with agreed maturity of up to 2 years dropped, whereas deposits redeemable at notice increased. The amount of cash currency in circulation practically did not change, but the rate of its annual change remained negative (minus 0.9%).

Annual change in some money indicators (%)

Source: Bank of Latvia

The domestic household deposits in March increased by 13.1 mil. lats, with the increase in lats deposits more pronounced. Household deposits benefited from the stable economic situation in the country as employment and salaries grew and a pronounced impact of reduced external demand yet to be felt. On the other hand, deposits could grow also as a result of weakening consumer confidence, which would promote limited consumption and increased accruals.

The deterioration of the industrial situation in Europe with a possible drop in export revenues as well as problems affecting some domestic enterprises could have acted to promote a drop in deposits made by businesses. Adding to the above factors repayment of short-term loans, deposits by businesses have dropped by a total of 137.4 mil. lats.

Primarily as a result of repayment of short-term loans in March, the balance of loans granted to non-financial businesses dropped by 1.3%, whereas the household loan portfolio shrank by 0.6% as housing loans were being repaid. Last month, only lending to financial intermediaries grew (by 3.4%).

The drop in money supply observed in March is in part related to such factors as repayment of short-term loans, which, under the conditions of restrained lending acts to reduce both the total loan portfolio and the accruals of businesses, as well as possibly more moderate external demand, which may be the case in the coming months. The rise in household deposits indicates, on the other hand, that changes in consumer confidence promote accruals, thus having a positive effect on money supply.

Textual error

«… …»