Entrepreneurs increase their accruals substantially

September was the fourth consecutive month during which enterprises substantially increased their deposits with banks while the accruals of households grew only slightly. On account of increased deposits, the Latvian contribution to the total money supply M3 also increased. In the area of lending, there were no substantial changes – the loan portfolio of nonfinancial enterprises practically remained unchanged, but the total domestic loan portfolio of banks contracted slightly, retaining the trend of the moderate drop in household loan portfolio.

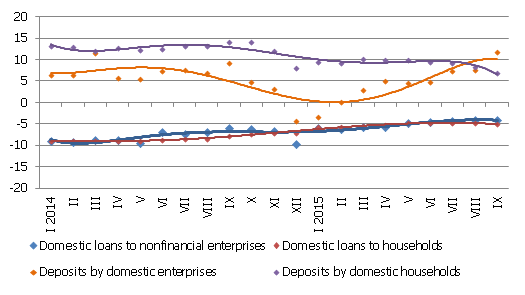

The balance of deposits attracted by banks increased in September by 0.6%, but the rate or their annual growth reached 9.0%. The contribution of enterprises was the determining factor in the rise of deposits: their deposits grew by 1.2% month-on-month and 11.7% year-on-year, whereas household deposits grew by a mere 0.2% and their year-on-year growth was at 6.9%.

As for the changes in the Latvian contribution to the euro area common money indicator M3, the overnight deposits of euro area residents with Latvian credit institutions increased by 2.0% in September and deposits redeemable at notice grew by 1.3%, whereas deposits with a set maturity of up to two years shrunk by 2.7%. Even though the amount of cash currency in circulation continued to diminish, Latvia's impact on euro area money supply was positive – its contribution to euro area M3 grew by 1.3% and by 9.1% year-on-year.

In September, the bank domestic loan portfolio decreased by 0.1%, with loans to nonfinancial enterprises increasing by 0.02% and loans to households dropping by 0.3%. The annual rate of drop for domestic loans in September was -3.7%, including -4.0% for loans to nonfinancial enterprises and -5.1% for loans to households.

Annual changes in some money indicators (%)

Source: Latvijas Banka

The September data support the earlier evaluations regarding both the slow recovery of the lending processes and the faster growth of enterprise accruals and more moderate growth of household deposits. Along with the impact of the Eurosystem's monetary policy (albeit it affects Latvia rather indirectly), the stability of the economy is expected to gain ever more pronounced reflection in the area of lending. Even though in several euro area countries and in the euro area overall, the loan balance is growing both in absolute terms and year-on-year, no rise in loans as yet is felt in Latvia, but there are more and more indications that it is not light years away. Among the latest, is the bank lending survey conducted in September, which confirmed: banks offer more favourable lending conditions and will continue to ease lending standards; at the same time, the demand for loans is rising and is expected to rise further in the fourth quarter of this year.

Textual error

«… …»