Economic stability provides for a more balanced money supply

The stable economic growth observed practically throughout 2012 has provided for a balanced increase both in deposits attracted by credit institutions and total money supply. As sharp fluctuations in the economic environment and particularly financial sector were not the case, the rise in money indicators in December was more moderate than at the end of 2011. The domestic loan portfolio shrank as is usual for December, yet the reduction was smaller than a year ago and was mostly determined by the repayment of short term loans in the non-financial business sector.

The seasonal rise in salaries in December provided for a more rapid rise in household lats deposits, at the same time reducing the amount of free resources at the entrepreneurs’ disposal. A reducing effect on business deposits was also a result of relatively large repayments of loans at the end of the year. In December, the deposits of non-financial enterprises grew by 0.7% and household deposits by 1.5%, yet in 2012 overall a pronounced superiority in the rise of business deposits was maintained, respectively 7.6% and 2.1%.

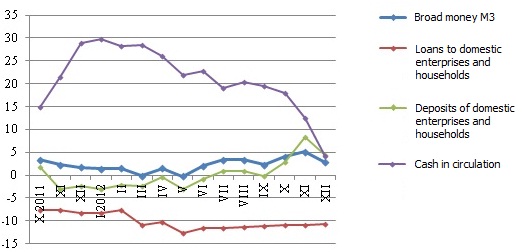

Money indicator M3, which characterizes the amount of cash and non-cash currency in the economy, rose 0.6%, in December as the domestic overnight deposits, deposits redeemable at notice and the amount of cash currency in circulation all continued to grow, and term deposits continued to drop. We must note the levelling out of the annual growth rate in cash currency and deposits (respectively 4.1% and 4.5%), which indicates that the focus on increased use of cash currency characteristic of the crisis years is over. The change in this focus is in all likelihood related to two factors: trust in the stability of the banking sector has been renewed and the grey economy may have shrunk.

Annual change in some money indicators (%)

Source: Bank of Latvia

In December the balance on loans granted to nonfinancial enterprises dropped by 2.8%, and the household loan portfolio by 1.1%. The main contributor to the drop in loans in December was the repayments of short-term loans by private enterprises, with the household loan portfolio shrinking relatively little. The drop, which was smaller than in December 2011 determined that the rate of change in lending to enterprises, with the indicators of banks that lost their licences in 2012 excluded from the base (-1.0%), is already approaching zero. Despite a drop in the total loan balance, both the amount of loans granted in lats, and their proportion in total loans continued to grow.

The positive mood of consumers and their growing income will determine the development in money supply in the first months of 2013. No sharp changes in trends are expected, however, with the economic situation improving further, a more rapid rise in accruals and a rise in competitive demand for loans can be expected. If the decision is positive regarding Latvia joining the euro area, in the second half of the year cash currency in circulation could drop substantially, as the Latvian population becomes more aware of the advantages of keeping non-cash currency in the currency exchange process.

Textual error

«… …»