The dynamics of money supply at the beginning of the year sustained by business success

In January, the main factor behind decreasing money supply was a seasonal drop in demand for cash currency, yet a drop in household deposits also played a role. The trend observed until November of last year – a small increase in lending to businesses and a moderate drop in lending to households – returned to the overall dynamics of the domestic loan portfolio. That determined an overall small drop in domestic loans while the annual loan drop indicator improved to minus 10.4%.

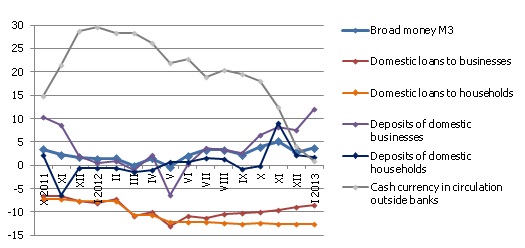

Money indicator M3, which characterizes the amount of cash and noncash currency in the economy, dropped by 0.3% in January while rising 3.7% year-on-year. The domestic overnight deposits and deposits redeemable at notice rose, but the amount of cash currency in circulation and term deposits dropped. With the use of cash currency dropping 4.3% month-on-month, its year-on-year growth rate was only at 1.0%. The sharp drop in annual growth was related to the high base – in January 2012, the seasonal drop in the demand for cash currency was negligible because of the related clamour had just ended.

Year-on-year changes in some money indicators (%)

Source: Bank of Latvia

In the first month of the year, the trend of stagnating household deposits, which had been the case for about six months, became more pronounced in contrast to the relatively rapid rise in business deposits. Apparently, facing the sharp rise in heating costs at the beginning of the year, the expenditures of the population were somewhat based on using deposits accumulated earlier. A part of households was nudged in that direction also by the seasonal rise in unemployment in January. The income of entrepreneurs, however, continued to rise because consumer confidence was optimistic domestically and even in the external market there were no worsening trends to be observed. The deposits of non-financial enterprises thus rose by 1.9% in January, whereas household deposits dropped by 1.4%. A pronounced difference was also observed year-on-year: deposits of enterprises grew 12.1% against the 1.7% of the ones of households.

The balance of loans granted to businesses in January increased by 0.1%, including loans to non-bank financial institutions by 5.7%, whereas the loan portfolio of households decreased by 0.7%. It was precisely the stability of the loan portfolio of enterprises that was behind the fact that the annual rate of changes in lending, with the indicators of banks that lost their licences in 2012 excluded, keeps approaching zero (minus 0.6% in January). Just as in previous months, both the amount of loans granted in lats and its proportion in total loans continued to grow in January.

The changes in money supply in January reflected stability of the economy –a slower rise in December was followed by a minimal drop in January, thus speeding up the annual rate of growth in the majority of money indicators. Albeit household deposits could continue to drop as a result of some factors, funds both from domestic consumption and the still hopeful export branches will continue to flow into the accounts of enterprises. Total money supply in the coming months will therefore continue to grow moderately. After the possible invitation to Latvia to join the euro area, an additional stimulus to a rise in deposits will be the opportunity to convert non-cash currency into euro more simply. A notable demand for loans will for the time being be observed only from entrepreneurs, moreover, the rate of annual change in loans granted to businesses in all likelihood will become positive this year (excluding the indicators of banks that lost their licences in 2012 – in the next few months). The household loan portfolio, on the other hand, will continue its dwindling trend as the gradual repayment of household loans continues.

Textual error

«… …»