Development of monetary indicators stable in February

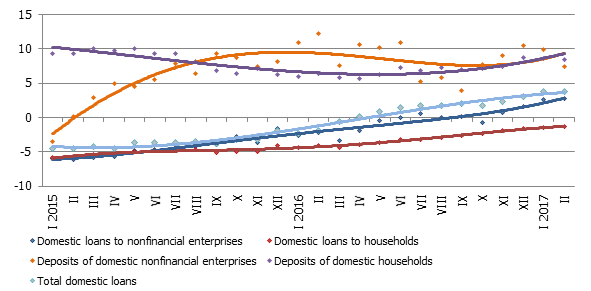

The balance of loans granted to domestic nonfinancial enterprises increased by 0.1% in February and the balance of those granted to households dropped by 0.2%, whereas the total amount of domestic loans remained practically unchanged. The year-on-year rate of growth of domestic loans also remained unchanged (3.8%), although it improved both for loans granted to nonfinancial enterprises (to 2.8%) and for loans granted to households (to –1.3%). The amount of newly granted loans (with the exception of reviewed ones) grew by 14.6% year-on-year in February (incl. loans granted to households by 10.3%).

The domestic deposits attracted by banks increased by 1.5% in February, but the rate of their year-on-year growth was at 4.7%. The deposits by nonfinancial enterprises grew by 1.9% (y-y growth rate at 7.5%) and household deposits by 0.6% (y-y growth rate at 8.5%). After decreasing for several months, the deposits of nonbank financial institutions were on the rise again.

As deposits rose in February, so did Latvia's contribution to the euro area money supply indicator M3 (by 1.4%; y-y growth rate at 4.9%). The overnight deposits by euro area residents with Latvian credit institutions increased by 2.8% and deposits redeemable at notice by 0.9%, whereas deposits with a set maturity of up to two years dropped by 5.9%.

The year-on-year changes of some money indicators (%)

The positive trends in the global economy are continuing and both the private and public consumption foster the consolidation of growth of the Latvian economy, therefore a moderate increase in deposits is likely to continue. This year once again, the economy will be supported by lending growth. The readiness of banks to lend is combined with the positive future expectations of entrepreneurs and households alike and the desire and need to borrow based on the necessity of investments.

Textual error

«… …»